Your spending is my income. And so the world turns.

We’ve had a financial crisis before where people stopped spending. Because the system locked up and looked about to melt down. Where the plumbing in the banking system got blocked.

In 2008, with quantitative easing and a range of other measures, governments and central banks started to get the world spending again.

The coronavirus world has fast become a different dilemma.

There’s no financial blockage in the plumbing. People can spend. It’s just that it’s not safe for them to go out and do so. Because they could contract this super-contagious bug. Spread it to someone elderly or ill. And flood the health system.

We’ve fast found the reality of what it means to have an ageing population. Look at Italy. Hospitals unable to cope. Funeral parlours and cemeteries overrun.

Fighting the virus in Italy. Source: Al Jazeera

The Italian connection

The average age of those who died in Italy is 79.5.

99% had other illnesses. More than 75% had high blood pressure.

One dark truth of this pandemic is we’re sacrificing our economies for the sake of the aged and the unwell. And our societies are ageing fast.

The coronavirus could be the warning sign of a coming battle worse than climate change. A battle between generations.

- Do we let the old perish to keep the world solvent?

- At what point will care for the elderly swamp our resources?

- Do we have enough working age people to fund pensions?

- Even if we do, can pension funds preserve returns in this choking economy?

- Are we facing a recalibration of the global world economic order?

These questions need deep thought and exploration. My own view is that the life of an 87-year-old is no less valuable than the life of a 7-year-old. We should not play God and decide who dies. Instead, it’s our duty to defend all human life.

The real answer is to resolve the challenges of longevity through innovative science and smart economics.

We need a vaccine and treatments for this new disease. Not enforced, long-term isolation that brings with it even greater challenges to free the wheel of spending. Greater challenges than even the GFC saw.

A historic ‘wartime’ response by governments

Here in New Zealand, we’re in a fortunate position. Relative to others. We have low public debt — somewhere around 20% of GDP.

But when you lock down spending and put so much GDP at risk, it’s doubtful whether any government has the resources to recover it.

Perhaps you can borrow to stave off a crisis for a year or so.

Then, if that doesn’t work, you still have the same perishing farm — now with a whole lot more debt to service.

And we saw this suspicion play out in the markets. A day upward on the back of these giant stimulus packages. The next day, a steep fall.

Yet, in reality, equity markets now seem a bit paranoid.

Not all businesses are at risk. Some will prosper through this crisis.

Large investment funds who sell everything — many of them index-based — are throwing the baby out with the bathwater.

The long-term upside

I’m an optimist. We’ve solved so many of the world’s problems through science. The coronavirus will, in time, be another freak weed that gets pulled.

When that happens, interest rates will be low. The world will be awash in money. Amidst the fear, funds will have sold off. Governments will be running economic buffets for the starving. Stocks may then soar.

Whether you’re 17 or 77, this presents a remarkable investment opportunity.

So, what is worth looking at now?

Anything that is not threatened by the spending endangerment.

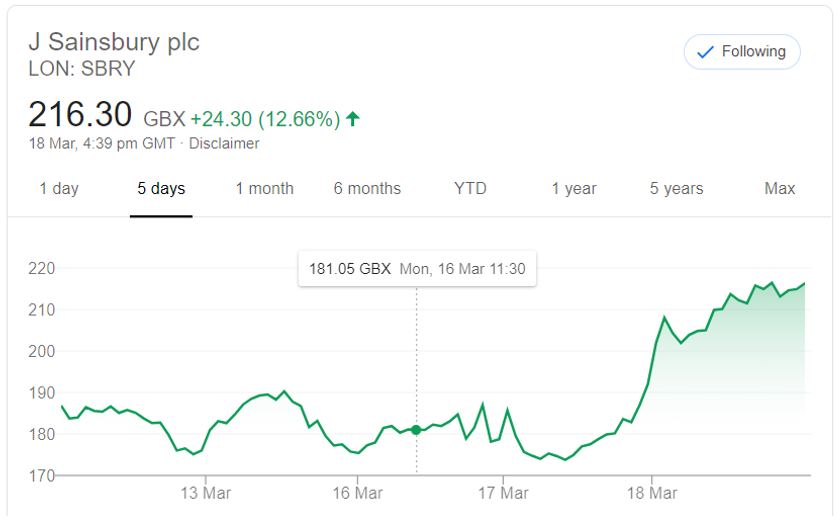

Long-suffering Sainsbury [LSE:SBRY] supermarket in the UK has bucked the FTSE collapse. It’s up the past week on the back of the business-rates holiday announced. And demand for the necessities of life.

Sainsbury bucks the FTSE’s fall. Source: Google Finance

Sainsbury is the largest tenant of one of the key recommendations in our Lifetime Wealth Investor programme. So is a certain pharmaceutical company that’s also bucking the trend. It’s holding ground with the occasional uptick, despite the undiscerning sell-offs across the market.

Immediate upside in this market comes down to the necessary reprioritising we’re all having to make in our spending.

We need a warm home. Food and sanitary items. Medicine. And, for sanity’s sake, a car with enough gas and a good radio.

Flights to Hawaii. Theatre tickets. New clothing. These can wait for the blue-sky days. This virus is hitting discretionary spending. Consumer staples, not so much.

And when it comes to investable assets, the enablement of spending is coming up king.

Even gold, the asset class of the paranoid, has come under pressure. Since early March, the price is down hard.

Light at the end of the tunnel?

China reported ‘no new local infections.’ An important milestone in stemming the tide. But is this entirely true? There has been very little uptick in the Shanghai Composite at the time of writing. This may also be due to increasing calls in the US to seek recompense from China for allegedly covering up and allowing the virus to spread during its critical early stages.

Yet we are still building a post-GFC type situation of monetary stimulus aplenty. Alongside pent-up demand that could feed a raging appetite for stocks once this global risk event is under control.

Either way, this whole situation is unlikely to do anything but heat up the global trade war that was already impacting markets. We can only look to a reworking of supply lines away from China. And investors appear to be considering as much, with a rush to the safe haven of the US dollar.

The road ahead

So, with much value coming to the table in stocks, is this the best time to buy, sell, or just hold?

If a business is solid and can withstand a dry period, you’re likely best holding on.

It will be the sickest businesses that die first. I notice Laura Ashley [LSE:ALY] in the UK — where I bought half my furniture — has gone into administration.

Fortunately, I got out of that stock years ago when growing debt-to-equity levels made me worry.

The best time to invest for the long-term is usually now. But certain times are better than others.

Get some independent advice. And if you can accept all the risks in return for the probable upside that these volatile markets present, do take a look at our Premium Research.

Regards,

Simon Angelo

Editor, WealthMorning.com

PS: In coming weeks, we’re looking to get a handle on how things are faring in that other big asset class — property investment. Our mortgage adviser David Paulin has an experienced handle on this. We’d also like to hear about anything you’re seeing on that front. Reach us on [email protected].

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.