They call him the Oracle of Omaha. A mythic title for a man who already has a mythic reputation. For him, nothing is ever left to chance. Nothing is ever driven by emotion or impulse. Over the decades, he’s built his unique brand of success by being disciplined, patient and methodical.

Source: Business Insider

So…imagine everyone’s surprise when Warren Buffett suddenly did something reckless and wild: he took a gamble. Yes, seemingly on impulse, he made a huge declaration in 2007 — over the course of the next 10 years, he believed that index funds would end up beating hedge funds.

For the Oracle, this was an extraordinary statement. A line in the sand. He was so sure that he was right that he was willing to place a $1 million bet with anyone daring enough to take him up on this challenge.

The finance industry, for its part, was stunned.

The Buffett gamble

How could Buffett be so irresponsible? Had he gone mad? Didn’t he know that this was a wager that he couldn’t possibly win?

The folks at Protégé Partners LLC, a hedge-fund firm, decided to step up to the plate. They agreed to his $1 million gambit.

And so…the contest of wills was on. But this wouldn’t be a sprint. This would be a long-distance marathon. At stake were two competing philosophies. Active investing versus passive investing. Stock-pickers versus index-pickers. Hands-on versus hands-off.

Who would prevail?

I’ll reveal that in a moment.

But, first, here’s some background…

What’s a hedge fund?

A hedge fund focuses on ‘active investing’. This is where portfolio managers pool together money to invest in a range of assets, with the goal of delivering you a positive return that’s above a particular market benchmark.

To do this, they spend a great deal of time studying global trends. Through a combination of historical data, future projection and gut instinct, a manager may choose to buy into new stocks that might give a better return, while selling existing stocks that are not performing as well.

Different hedge funds will offer different strategies for investment. But the core principle remains the same: portfolio managers will charge you asset-management fees in return for their hands-on service in stock-picking.

What’s an index fund?

An index fund focuses on ‘passive investing’. This is where a basket of assets is put together to ‘track’ the average performance of the market.

There are a wide variety of index funds on the market, representing every possible combination you can think of.

Do you want to track the 500 largest American stocks that comprise the S&P 500 Index? Why, yes, you can buy into a fund that captures that slice of the pie. When you do so, you won’t own shares in any one company, but you’ll be part of an account reflecting 500 companies simultaneously.

Or…maybe you’re being more modest. Maybe you just want to track something on a smaller scale. Something more niche. Maybe just property on the New Zealand Stock Exchange? Well, yes, you can readily buy into that.

Or…maybe you’re after something much more speculative, more esoteric. Perhaps robotics and artificial intelligence in Japan? Mm-hm, you’ve guessed it — there are index funds for those as well.

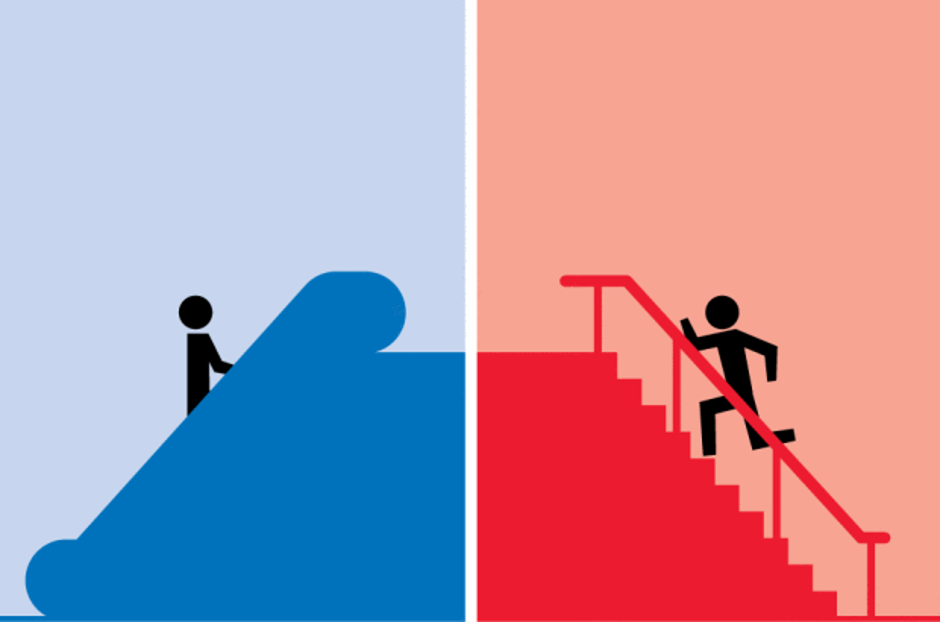

Active vs passive

Now, in the grand scheme of things, regardless of what index fund you choose, the main principle remains the same: the only real control you have is your initial decision is to buy into an index fund. And then…it’s pretty much hands-off all the way. There’s no portfolio manager actively managing the fund; no person making decisions about what assets to buy or sell.

For this reason, the maintenance fees for an index fund are minimal. And it’s easy to understand why — you’re taking human intervention out of the equation entirely.

Active investing vs passive investing. Source: Financial Post

What happens what you pit an index fund against a hedge fund?

Let’s go back to Warren Buffett’s gusty gamble.

Remember: he made a bet of $1 million in 2007. He declared that over the course of 10 years, an index fund would outperform a hedge fund.

When Buffett made that statement, many people thought he was nuts. This included Protégé Partners, the hedge-fund firm that agreed to take up his challenge.

And so…the race was on. There was high drama and high emotions as the miles ticked on.

At first, the hedge fund run by Protégé Partners zoomed ahead, quickly overtaking Buffett’s chosen S&P 500 index fund.

There was much cheering and jubilation from the stock-picker crowd. It looked like the Oracle of Omaha was wrong and would surely pay for his hubris.

A photo finish

But that early confidence soon waned. Impossibly, incredibly, the index fund came from behind, starting to accelerate, drawing level with the hedge fund.

The stock-pickers were shocked into silence.

Surely this couldn’t be happening?

But, yes, the index fund overtook the hedge fund. And eventually, the match concluded in thunderous fashion in 2017.

The final result?

Buffett’s S&P 500 index fund posted an average return of 7.1% per year. This is in stark contrast with the hedge fund run by Protégé Partners, which posted just 2.2% per year.

Buffett victory

How on earth is this even possible?

When we do a careful analysis, we can start to see why Buffett was so confident of the outcome — he knew that index funds charge lower maintenance fees yearly compared to hedge funds. And in the long-run, this has accumulative effect on net profit.

But he may also have been aware of the market dynamics of the ensuing decade, which provided more difficult conditions for active managers.

So, all things considered, you could say that the Oracle had an ace up his sleeve all along! Buffett won the bet decisively, and with good-hearted joy, he donated the proceeds to charity.

Can you find a good balance?

Some people dispute Buffett’s victory. They say that the end result was a fluke or that he knew certain conditions were evident in the mix. Not all index funds will beat all hedge funds. Your mileage may vary.

Still, what Buffett has proven is that once you strip away all the jargon, the truth is that investing isn’t reserved for experts alone. It’s not some secretive magic available only to a select few. Even beginners can get a healthy start in the market, provided they have the courage to give it a try.

In fact, when you go beyond index funds and hedge funds, you might actually discover other ways of finding value. Here’s one bright idea: why not act as your own portfolio manager and learn how to actively manage your own stocks?

How to invest like Buffett

The advantages here are threefold:

- You avoid the random nature of index funds.

- You avoid the high fees of hedge funds.

- You get to pick individual stocks that fit your personality and goals best.

Intriguing? Yes, we certainly think so.

Here at Wealth Morning, our goal is to help you create a well-rounded global portfolio. We do this through our passive income ideas research service. And so far, it’s showing great promise. We’re seeing positive growth in stocks in the UK, US, Australia and Singapore.

If you’ve ever wanted to get started in stock-picking, let us show you how. You might just be a future Oracle but don’t know it yet!

Regards,

John Ling

Contributor, WealthMorning.com

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.