When it comes to shares or property, you make your money when you buy.

But with everyone trying to bag a bargain, where do you look?

Occasionally you get lucky. The first home I bought in Auckland was on such a busy road that most people discounted it. They didn’t even bother to look. But I could see the value. Which was confirmed when someone offered to buy my sale contract for $10,000.

Strong competition in a market can show the potential of that market. People are factoring in growth. But competition and FOMO (fear of missing out) can also inflate prices to the point where there’s a negative value gap. And for investors, poor yield.

At some point, such a market may correct.

Value gap

This is the gap between the intrinsic value of an asset and its current price.

Value gap is an investor’s best friend. A positive value gap means there could be a ‘make money when you buy’ opportunity.

A negative value gap means that unless strong future growth is assured, you could be making a poor investment.

Alongside value gap, you need to consider yield. Especially net yield. This is the percentage of the asset cost returned in net income each year.

The ideal situation is positive value gap and strong yield.

But this is generally found in situations most people aren’t keen on. The fruit is bruised. You need to consider the overall situation.

Shares with value gap

Financially, you can value shares by many measures.

For example, DCF — Discounted Cashflow.

DCF considers the value of a company today by reviewing projections of how much money it will generate in the future.

Unfortunately, on the NZX, there is very little incidence of a value gap.

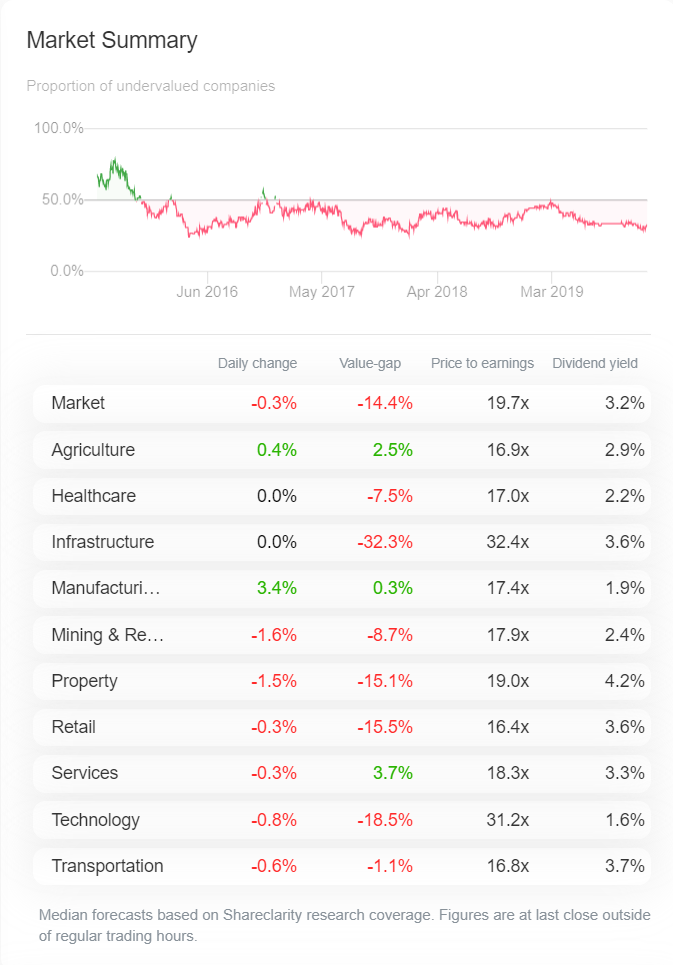

Take a look at this recent report from ShareClarity on the NZX:

Most sectors have a negative value gap. And yields are as low as 1.6% (in the tech space).

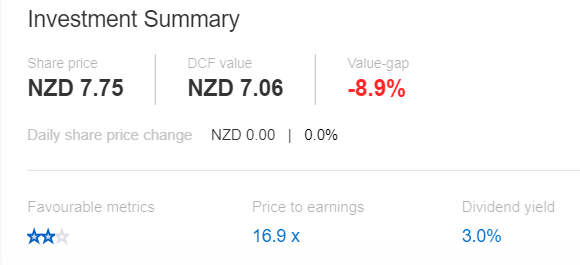

Which is why I seldom invest on the NZX these days. I’ve probably topped up on only a couple of stocks this entire year. One of the last being fishing company Sanford [NZX:SAN], which ramped up from around 6.50 in August to 7.75 at time of writing.

And now the value gap seems to have gone:

So now I invest on exchanges like the LSE (London Stock Exchange), where it’s possible at the moment to find a positive value gap and reasonable income yields.

You can view our latest LSE Portfolio — and other value-gap opportunities worldwide, including in Australia — by joining Lifetime Wealth Investor.

Property with value gap

Property can be a bit more difficult to value.

The problem with most valuations is that they are not cash-flow based but rely on the sales of other homes in the same location.

So, if an entire city is at risk of being overvalued, all valuations may be rich.

Property values can also get inflated by high mortgages, migration, building shortages, and geography issues. A mortgage compliance audit could help you identify any issues with the mortgage on the property, and make sure you’re in a good place to make back your investment.

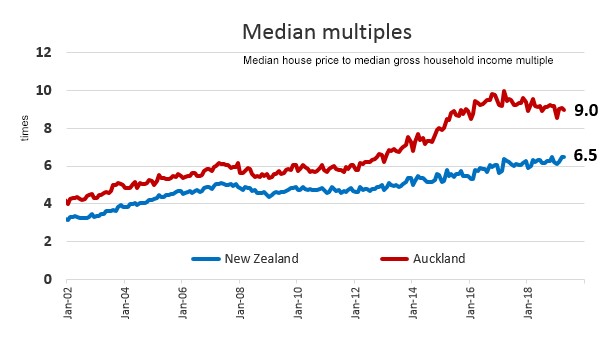

A possible way to consider value gap, at least with residential property, is to consider the house-price-to-income multiple. This is the ratio between median house price and median annual household income.

According to the World Bank, this ratio is ‘possibly the most important summary measure of housing market performance, indicating not only the degree to which housing is affordable by the population, but also the presence of market distortions’.

If we run this test over Auckland and New Zealand — since I bought my first home in the early 2000s — we can see a dramatic decline in affordability:

Bad government policies

During this time, we faced building shortages, some of the highest rates of net migration in the OECD, and a massive ramping up of mortgage debt.

For example, in the year to June 2019, New Zealand experienced net migration of 11.4 people per 1,000. This compares to 3 per 1,000 in the United States.

While both countries seem on target to achieve GDP growth over 2%, New Zealand’s growth appears dependent on population growth via migration of about that level.

Perhaps the housing market does too.

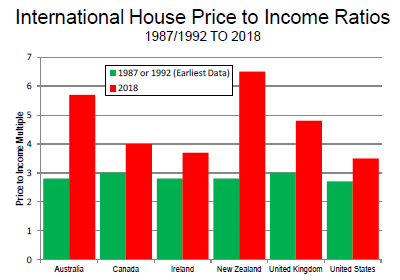

If you’re struggling to afford housing, government population planning is responsible. High migration countries experienced affordability plunges. But none more so than New Zealand:

It’s hard to see sustainable growth in Auckland with prices at some 9x median household income. You have to bring in savings from offshore. Or be already significantly invested.

Or borrow too much.

Big mortgages are a factor. Household debt-to-GDP is among the highest in the world.

But you could get lucky in a slowing Auckland market. Especially as the liquidity trap emerges.

A question of liquidity

One of the reasons I tend to prefer shares is due to their liquidity. You can generally sell shares in most larger businesses on the exchange and be cashed up in a few days if you’re happy to accept the market price.

Not so in a slowing housing market. You might have to wait months to sell. For a desperate or debt-stressed seller they may just let their property go at a lower price.

And, anecdotally, I’m hearing of residential rental investors wanting to get out sooner rather than later. Before increasing tenancy regulation puts the screws on them.

Generally, though, you’d be hard-pressed to find a value gap in Auckland.

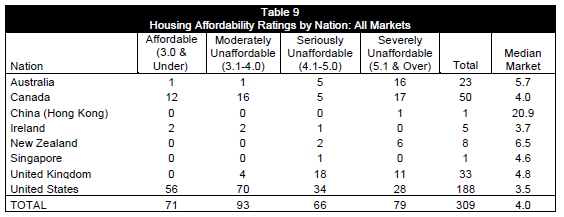

If you’re looking to invest in housing in a metropolitan market, there are likely many more opportunities in North American or European markets:

Looking for better options abroad

In fact, I’m aware of property investors who are Wealth Morning readers investing in rental property in the UK and North America.

Simply bigger markets. More pickings.

But there’s also forex considerations.

So…a property pick?

Robert Kiyosaki, author of the property-investment focused bestseller Rich Dad Poor Dad, is a Phoenix, Arizona resident.

That city has a similar population, yet is around twice as affordable as Auckland with a house-price-to-income multiple of 4.3. Rental yields in Phoenix ran at around 8.7% in 2018.

Value trap or desert vacuum? Take a visit to find out more…

You’ll find more value traps and value gaps as you continue on your investing journey. And the more experience you build in share or property markets, the more knowledge you’ll build.

Market knowledge is the key to identifying value gaps. And then you will be the one who makes money when you buy.

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.