Before the time of cryptocurrencies and the internet, people used to trade gold and silver. They still do so now. Gold has always been worth more than silver. But there is still a big presence for silver in today’s world, and money can be made off it.

In the crypto world, most of you would have heard of the biggest leading cryptocurrency — bitcoin. As of 3 October 2019, bitcoin is sitting with a market capitalisation of US$149 billion. A lot of people have called bitcoin the gold of the cryptocurrency world.

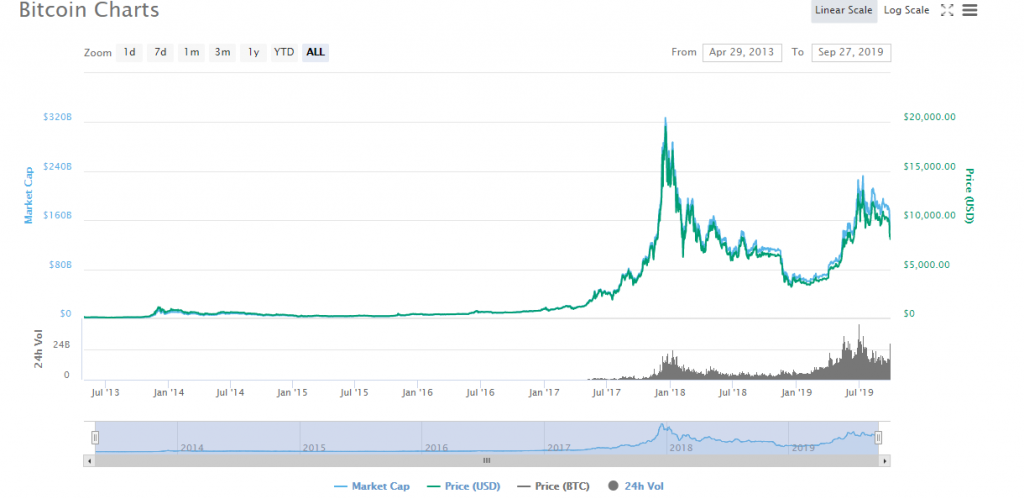

This historical chart shows bitcoin’s price movement over 6 years. Starting from 1 May 2013, bitcoin was US$135.30 per coin. It peaked at a high of US$19,738.06 per coin, then stabilised around US$5,000–US$10,000.

History of bitcoin

Bitcoin was the first decentralised cryptocurrency. On 31st October 2008, Satoshi Nakamoto published a white paper, describing in detail the functionality of the bitcoin blockchain network.

On 3 January 2009, the first block was mined on the bitcoin network.

On 22 May 2009, the first ever recorded purchase of goods that was made with bitcoin. Laszlo Hanyecz brought 2 pizzas for 10,000 bitcoins. As of 27 September 2019, those 10,000 bitcoins would be worth US$79,959,000.00!

A lot has progressed with bitcoin since 2013. Other cryptocurrencies have been developed. There are many that are sitting over US$1 billion in market capitalisation.

But, right now, let’s look at who bitcoin’s closest competitor is.

If bitcoin is considered gold in the crypto world, naturally enough, this competitor might be considered silver.

The cryptocurrency acting as silver to bitcoin’s gold

Litecoin is a cryptocurrency that’s sitting at over US$3 billion in market capitalization.

In terms of functionality, it is considered the closest rival to bitcoin. Litecoin’s purpose is also to transfer money over the internet, as well as paying for goods and services.

As you can see from this graph, litecoin had relatively the same movement as bitcoin from May 1 2013. It started out from only being around US$3 to reaching a record high of US$375.29 in December 2017.

The key difference between bitcoin and litecoin is that bitcoin can only have a total of 21 million coins in circulation. Meanwhile, litecoin will have a total of 84 million in circulation.

Litecoin is also faster at making blocks and confirming transactions. Litecoin uses a hashing algorithm called Scrypt as opposed to SHA-256 for bitcoin.

Scrypt is less complex, and the algorithm does not require such a high hash rate as opposed to SHA-256. Statistics have shown that the average bitcoin transaction takes 10 minutes to be confirmed, whereas the litecoin equivalent only takes 2.5 minutes.

Bitcoin and litecoin merchants

There are many different merchants that accept bitcoin and litecoin as payment options.

The big question now: is it better to favour litecoin over bitcoin?

Merchants are considering this because it is roughly 4 times faster for litecoin to confirm a transaction. However, on the other hand, merchants can opt into accepting bitcoin transactions without waiting for any confirmation at all. This could potentially compensate them for litecoin being 4 times faster.

That being said, litecoin has been accepted as a payment option by over a thousand companies. One such company is Overstock, a large internet retailer which ships home décor merchandise. Another example would be Shopify, an e-commerce provider providing business support to small merchants worldwide.

Litecoin’s potential future

Litecoin will only be able to have 84 million coins in total circulation. That means that there will be a huge demand once its total supply is hit.

As of 3 October 2019, there are around 63.38 million litecoins in circulation.

On average, around 7,200 litecoins get mined every day.

That is around 2.6 million mined each year.

In about 7 to 8 years, the total supply of litecoins will be in circulation. That’s 84 million litecoins to be shared amongst 8 billion people around the world.

Everyone won’t have a fair share of the pie. This may lead to highly competitive demand for litecoin.

Regards,

Alistair Bilkey

Contributor, WealthMorning.com

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.