A lot of people don’t realise this. Your money can work a lot harder than you. It doesn’t get sick, go on vacation, get pregnant or fall off the ladder.

My definition of ultimate wealth is when your money earns more than you do. And there’s a simple calculation to discover if you’re ultimately wealthy.

Take your nest egg. Multiply it by 8%. Can you live the life you want to live on that?

Answer yes? You’re ultimately wealthy. Enjoy the cruise!

No? It’s not too late to get your money working harder than you.

Why 8%?

In my experience, a competent investor can achieve an annualised average of 5-10% over the long run without taking excessive risk. This combines a target running yield (income from dividends) of 5%, with capital growth targeting 5%.

Some may achieve more. In my portfolio, I’ve seen over 20% since the beginning of this year, thanks to a bumper year for dividends and some strong market growth.

But it’s important to remember that past performance is no indicator of the future. Change is constant. Markets and individual shares can rise or fall — often quickly.

So we take a conservative, potential long-run return of 8% per annum. Which you aim to generate without drawing down your initial capital.

That way, you may still leave this world with the dignity of an inheritance for the next generation.

But what about the risk to capital?

Indeed, when you buy stocks, you take on the risk of individual businesses. Their fortunes may vary. So you make the best assessment you can — and then you diversify.

Studies show that by purchasing just 16 stocks, you can achieve 90% of the benefits of diversification. And 95% with 30 stocks.

The skill (and sometimes luck) of an investor comes down to generating ‘Alpha’ — additional return over the market return. Plus, return in excess of the risk you’re taking.

Alpha (α)

Alpha measures the return you receive over and above the benchmark index.

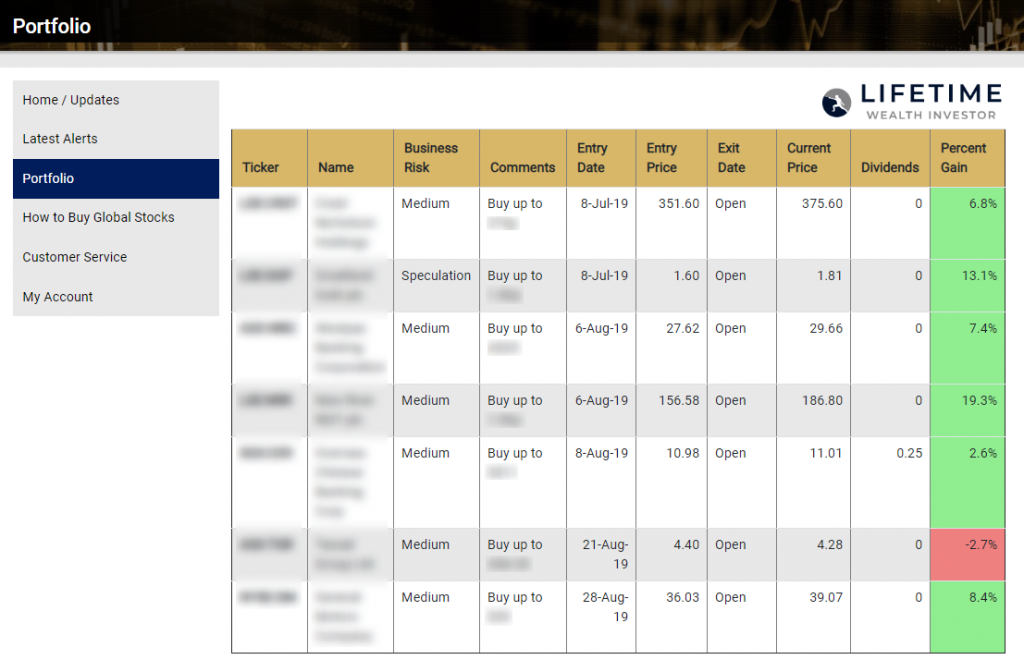

As we run a global portfolio in our Lifetime Wealth research, our benchmark is the global MSCI World Index.

In the near 3 months we’ve been recommending this portfolio, the gross average return (positions equally weighted) has been around 7% for that period.

The MSCI World Index over about the same time is showing a drawdown of –3.51%.

This would suggest Alpha of over 10%. So, yes, we’re a little chuffed.

But, of course, it is early days.

Sharpe ratio

Then there’s the question of risk. The Sharpe ratio measures the return of an investment compared to its risk. In the calculation, you deduct the risk-free rate from the return and divide this by the standard deviation of the portfolio’s return.

When an investor achieves a high Sharpe ratio, it means they have achieved a more attractive risk-adjusted return.

In other words, this ratio deducts the risk-free rate from the returns and then considers the volatility (ups and downs) of the portfolio.

For now — what you need to know — is when you see an investor achieving great returns, ask the question: How much risk are you taking? And what stocks are you buying? Are they larger businesses or supported by real assets? Or are they small-caps with valuations dependent on future prospects?

Become ultimately wealthy

To join the path to financial independence, begin by working out your required annual lifestyle income. Divide this by 8%. This is your freedom fund — the capital sum you’ll need to potentially generate the returns needed.

For example, John and Helen would like $40,000 a year — earned beyond their jobs or later pension.

So $40,000 divided by 0.08 (8%) is $500,000.

Now, this does not consider inflation, tax or the risk of a major market crash during the investing time frame. But it does give a basic guideline on what is possible.

As your money earns while you don’t, you gain more time. To do what you really want. Or at least the option to.

To see our Lifetime Wealth Investor portfolio, click here.

Well, that’s enough work for one morning. It’s over to the money now…

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.