I want to ask you a question.

What are the truest words you’ll ever see in finance?

Answer: ‘Past performance is not an indicator for future performance.’

Several years ago, people began telling me, ‘Stocks are too high. I wouldn’t buy now.’ Optimists said they were due for a correction. Pessimists a crash.

They missed out on big gains, both in New Zealand and other markets. While they waited in term deposits paying around 3.5%.

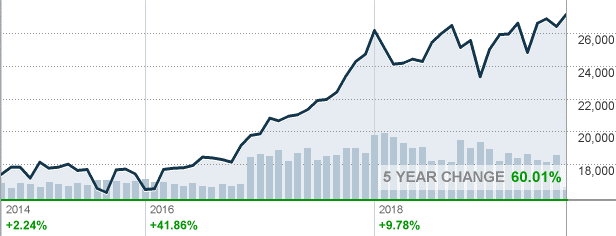

The NZX 50 is up 24.98% since the start of this year. The Dow is up 16.53% (year to date) and more than 60% over the past 5 years:

But can these gains continue? It’s like asking whether the All Blacks can guarantee their 17-year Bledisloe Cup-winning streak will continue for the next 17 years. Or whether the deregulatory Trump effect boosting the US economy from 2016 can last.

In fairness to those who missed out on these gains, many investors are still traumatised by 2008 and 1987.

Yes, even 1987.

Here in New Zealand, the very mention of that date fills many with dread and fear. Life savings wiped out.

But back-back. No experienced investor would be buying like it’s 1987 today.

P/E multiples were as high as 50. You paid 50x earnings to buy a company.

Many of these companies themselves were taking outsized risks. And some of their business models were confusing and obtuse, to say the least.

Still, some 40% of the adult Kiwi population plunged into stocks. For fear of missing out.

That did not end well.

I remember, as a kid, Mum and Dad didn’t even have enough money to buy an ice-cream on the weekend. Especially since mortgage rates reached crazy highs.

So I don’t blame people bearing the scars of ’87 for being wary of investing in equities.

But — that phrase again that fund managers must use — ‘Past performance is not an indicator for future performance.’

The performance leading up to 1987 may never get repeated. And equally, we may not see the crash, burn and phoenix-like rise of 2008 again either.

We are in a buy-and-hold bull market. One of the longest on record. But it is steady, there are still pockets of value, and we cannot predict if — and when — it will end.

One reason for our inability to call it is the interest-rate environment

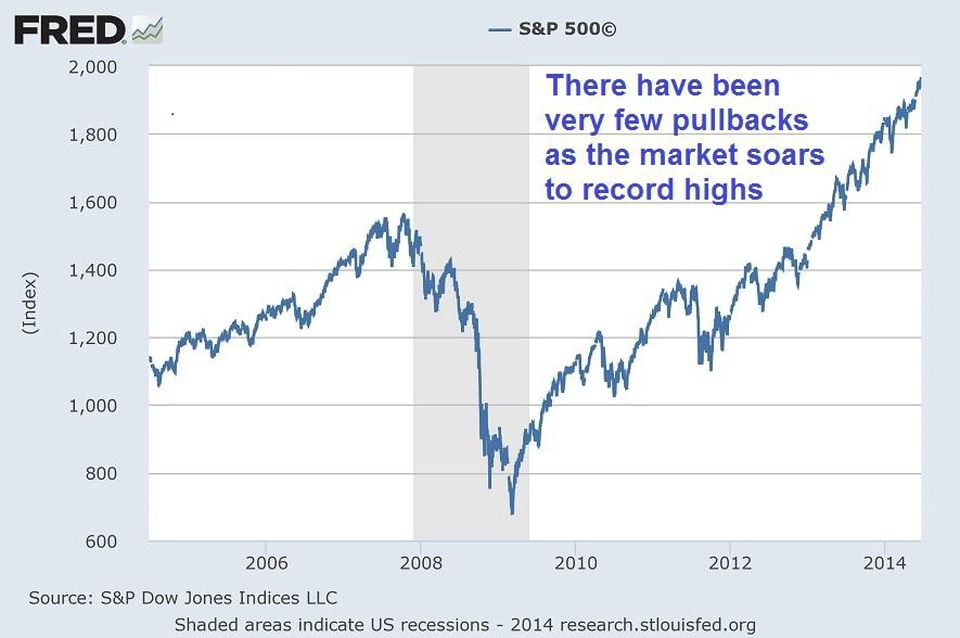

It’s unprecedented. And it goes back to 2008 — The Global Financial Crisis. One of the steepest drops in the Dow Jones Index (and others) since 1929. Followed by one of the steepest recoveries.

By March 6th 2009, the Dow had lost over 54% of its value since the high on October 9th 2007.

But then on March 9th 2009, it reversed its course. It recovered 60% by the end of the year!

March 2009 was a heart attack.

The Fed and other central banks applied defibrillators. The sudden shock of deep interest-rate cuts and quantitative easing — through buying bonds and other measures.

But this treatment hasn’t exactly revived economies or resolved the debt threat. It’s led to one of the biggest asset-price runs in history, as investors facing a low interest-rate environment hunt for yield.

‘In a world where investors knew interest rates would be zero “forever,” stocks would sell at 100 or 200 times earnings because there would be nowhere else to earn a return.’

—Warren Buffett

This environment we find ourselves in — at least in the developed world — is coupled by:

- Ageing populations looking to fund retirement.

- More people living off unearned income than ever before.

- A booming passive investing industry for unsophisticated investors.

- Globalisation and automation threatening and destroying jobs.

- Government compliance strangling business.

And it’s created a vortex. I term it ‘Richflation’ — or perhaps for many, ‘Bitchflation’.

If you’ve actively invested in certain assets at scale, you’ve seen mammoth growth in your wealth. If you haven’t, you might be struggling with high debt, job insecurity and anger at the elite.

In Richflation, those holding assets get rich. Those without see their incomes stagnant and face debt mountains to get into the game.

Shares — globally. Auckland property. They’ve all enjoyed global Richflation.

And if you’re on the wrong side of that coin – it’s just Bitchflation.

It’s helped the rise of some populist leaders. Trump. America First. BoJo and Brexit. Salvini, waiting in Italy.

Trump’s approach to some degree seems to be working. Unemployment in the US is at a record low. And GDP is growing across the board — at least more than before.

Europe seems to be decompressing.

Just the other week, the ECB cut its deposit rate to -0.5% and announced a QE bond-buying programme. The EU is sick, struggling under the weight of taxes, compliance and old age.

Unfortunately, the Europe I left has arrived in New Zealand

High business taxes. Intensive compliance. And interest rates in free fall.

But the low interest rates don’t seem to be sparking economic growth. It can take a full 4% of cuts to pull an economy out of recession. No room left now.

As our ageing population hunts for yields — it’ll likely continue to boost the stock market. Yet drivers for property and jobs are gone. These rely on other demand factors.

And worse: the property market is boob-jobbed on easy debt. Now, it’s cheap debt. We know how that goes when the silicon implodes. We’ve been there. Remember 2008?

So what is an investor to do?

Well, as we see it, while low interest rates remain (and remain they’ll have to), stocks could stay heady as the buy-and-hold bull rolls on.

But many — especially on the NZX — are expensive. Not at 1987 levels. But heady.

So you have to pick amongst the trail of global volatility and find patches of value.

See, passive investors and short-term traders fail to target long-term upside. And they make up the bulk of the market.

That leaves opportunity for the active investor. Perhaps like never before.

We’re seeing value in Britain. Global companies, pulled down in the pound and FTSE maelstrom of Brexit.

P/E multiples on some good businesses in Europe are similarly favourable. Although the outlook remains questionable.

America is an outlier at the moment. Interest rates are higher. And there are two camps. Either Trump’s policies will work and return America to the world’s number-one manufacturer and exporter. Or they’ll run out of steam.

You bet on him. He’s betting on Twitter. But the horse is running fast.

Well, you can see what we’re betting on in our Lifetime Wealth Investor research newsletter.

It’s coming along nicely. We’re getting into the companies with our research. And our top picks are moving toward double-digit returns in the two months we’ve been on them.

So, is Richflation still to come for some? 2020 will reveal more…

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.