Nothing’s worse than being undermined. As a parent. A leader. A manager.

That’s just what happened to Boris Johnson. He was defeated in Parliament this week.

First, opposition parties and Tory rebels got a bill through to stop a no-deal Brexit.

Then, when Boris sought to call an early election to put his position to the country, that too was voted down.

Now he’s lost his parliamentary majority after sacking 21 rebels who voted against him.

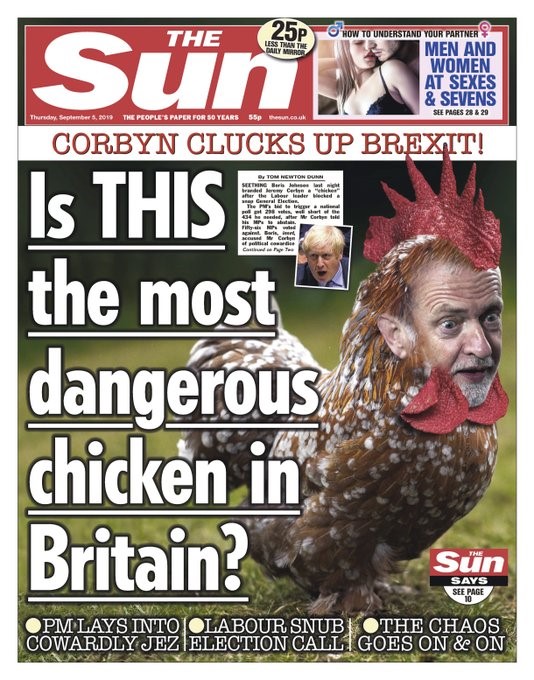

And Labour leader Jeremy Corbyn has said his party will only support calling a general election after the no-deal bill gets passed. It’s a move many see as cowardice since Corbyn appears afraid to go to the country without a protected Brexit position.

So what does this mean for Brexit?

Well, Boris may have to go back to the EU and ask for yet another extension. The UK’s negotiating position, which was finally showing some strength, has now been crushed.

Essentially, you have Parliament squabbling over how to leave the EU. And while this happens, the insecurity of Brexit remains.

For investors and business, this insecurity is more poisonous than Brexit itself. Investment and commerce require forward planning.

In the second quarter of this year, the UK economy contracted 0.2%. The pound is weak, and FTSE stocks are down.

But other EU nations have also suffered. German exports to Britain dropped 21% in the three months to June. The biggest fall since the financial crisis.

There are two schools of thought when it comes to leaving the EU with no deal

First, it will devastate the UK. There will be mass unemployment. Rubbish piling up in the streets. Shortages of food and medicine. Riots and civil disorder.

Second, it won’t be very bad at all. There will be an initial hit as systems and processes regroup. Some significant inconvenience over the short- to medium-run. Then the UK can grasp the opportunity and benefit from new economic freedoms.

Having spent a couple of years working between the finance centres of Jersey and London, I’m in the latter group.

Britain has a trade deficit in goods with the EU to the tune of £93 billion — about USD $114 billion.

This is significant, considering the UK represents only about 12% of the current EU population. If you take the size ratios, the deficit is approaching the scale of the US and China, now well in the throes of a trade war.

If Britain were to crash out of the EU with no deal, there are WTO rules to fall back on, as well as the no-deal preparations that are already in place.

These would mean, at least temporarily, that 82% of EU imports would remain tariff-free, down from 100% now. And 92% of imports from the rest of the world would pay no duty, up from 56%.

You can imagine the potential benefit to ‘rest of the world’ producers like New Zealand.

In the wine industry, for example, Australasian wine exports to the UK attract a tariff of about 10-12p per bottle — compared to French producers who pay nothing.

This is a complex area. But the point is that the UK’s import dependency on the EU is not irreplaceable. And given recent impacts on the German economy from Brexit uncertainty alone, I suspect the EU wants a deal as much as those cowardly Brits who walked out on Boris.

Of course, the export side is more tenuous. Especially in areas like financial services, where Britain has a significant trade surplus.

Yet, even Bank of England Governor Mark Carney, lead Brexit doomsayer, has admitted that a no-deal may not be as bad as first thought due to precautions that have shored up confidence.

A defining moment for Britain

It’s a polarised country.

Years of the nanny state and a bureaucracy that borders on Soviet levels have bred huge swathes of liberal socialists opposing any view that is not EU-positive, atheistic or politically correct.

At its extreme, I came across men threatened with redundancy from their jobs should they express any pro-Brexit sentiment. Or girls threatened with expulsion from their school for wearing a skirt or a cross. But this is another story…

You only need to speak with the many people who have fled modern Britain or wish to do so to understand this polarisation.

There’s a sense that the courageous conservatism that built an Empire and stood up to Nazi Germany is being marginalised.

And that still very large segment of the population believes that leaving the EU and its myriad of regulations and controls could return Britain to a stronger time.

Boris Johnson has been their champion. Going all out, where Theresa May would not.

While there are market threats from Brexit, there could be much greater market threats in having a socialist leader like Jeremy Corbyn at the helm. Particularly for certain company stock that he’s expressed desire to nationalise.

Moderates believe the way through is a compromised deal.

All they have done is compromise their chief negotiating position.

It’s much more difficult to succeed while blinking.

Financial markets

The financial markets are short-term thinkers.

With the probable blocking of no-deal, we see a rise in the pound and FTSE. Some of our recommended positions in our premium newsletter Lifetime Wealth Investor are up nicely.

But these dividend-paying positions — one yielding over 10% — may look even better in post-Brexit long-run bets, especially once the UK leaves the EU and can focus on growing its economy.

A hard Brexit will likely see a cut in the Bank of England base rate. Equities facing a more certain outlook could rally as the only place to get yield.

Meanwhile, unemployment is already at historic lows. We could see wage growth as more local production and employment is needed. Wage growth means more domestic spending. And a better outlook for businesses.

As in any market, to find value, you must take some risk. And if you believe the long-run outcome of Brexit is not as bad as the bulk of short-term-traders fear, you could do very nicely.

It’s an opportunity we’re exploring for readers in our premium newsletter, Lifetime Wealth Investor.

It will be fascinating to watch what’s in store next for Boris. Trump says that Boris ‘knows how to win’ and ‘is going to be fine.’

Fortune favours the bold. Let’s hope that’s still the case in modern Britain.

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.