On Sunday, I’m having a chat over coffee with a couple of mates. Both are involved in two large businesses. One deals with shipping. The other industrial products.

And they’re seeing a big slowdown. Like someone’s turned the tap well down.

A couple of other contacts are active in the Auckland property market. Despite the promises of hope by those working for large banks and real-estate companies, they’re seeing little but numbness in the $1.5m+ end of the market.

Meanwhile the Kiwi dollar continues to slide. It’s just dropped below US63c, the first time in four years.

Large export-focused businesses on the NZX are joining the grinding slowdown. The Fonterra Co-operative [NZX:FCG] share price is down over the month. And a2 Milk [NZX:ATM] has crumbled from a high of near $18, going right down to the mid-$14 range at the time of writing.

What’s happening? And what’s in store for your local investments?

The ramping up of Trump’s trade war with China is leading to a ‘global slowdown’. He’s hitting their factory production where it hurts — making hitherto cheap goods up to 30% more expensive by the time they reach the US market.

Be careful with the term bandied in the media: ‘global slowdown’. Markets interlinked with China are slowing down. The US — still the world’s largest consumer market — appears to be continuing to grow. Particularly consumer spending, which makes up about two-thirds of the economy. That grew 4.7% on an annualised basis in the second-quarter of this year, topping all forecasts, with the biggest gain since 2014.

This month, in investor calls, dozens of chief executives have already signalled plans they’re going to diversify their supply chains away from China. A reminder that, in the global consumer economy, the production component can move and quickly.

China and those reliant on its growing market are the ones most in line for a slowdown.

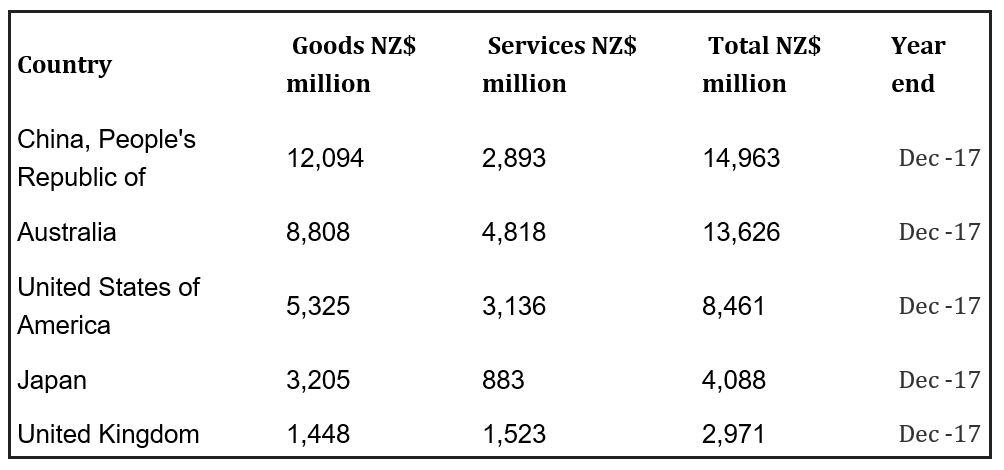

Unfortunately, New Zealand’s largest export market is China:

We’ve been here before.

In the 1970s, we depended on the British market. Then Britain joined the EEC and effectively abandoned our trading economy at sea.

Trading, as in investing, requires a diversification of markets.

Now, you may be looking at the above table and feeling some comfort on our big export numbers with Australia. But that market sits on the same fault line.

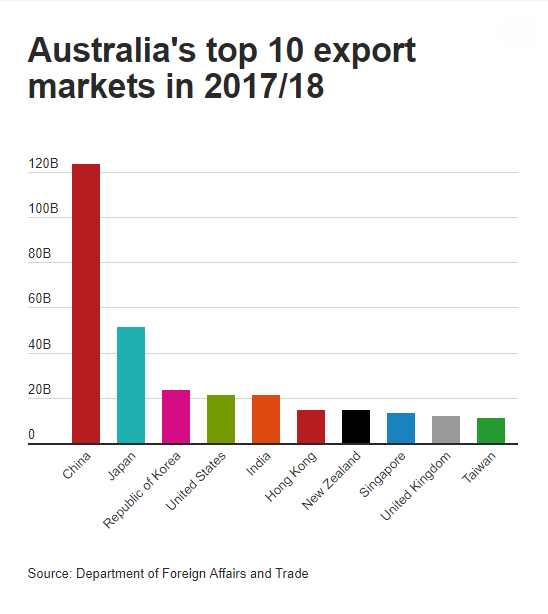

Australia’s largest export market is also China.

Analysts there see a potential cut to national income of 7% and 550,000 job losses should the Chinese economy experience a hard landing.

And, yes, Trump seems determined to throw the Chinese economy into a hard landing. There’s years of resentment at stake due to China’s record in trade and in dealing with intellectual property.

Australia, the Lucky Country, could run out of luck.

Right now, I’m looking to diversify more investing outside of New Zealand.

The weakness of the Kiwi dollar has just made this a whole lot more difficult — unless, of course, you hold foreign currency. Ideally USD.

But there are patches of value on other markets. And with upside.

The pound is weak due to Brexit. Many FTSE stocks are trading at a discount and possible margin of safety.

The euro has strengthened somewhat but still appears soft. Weighed down with its own concerns around Brexit, Italian politics, low-to-negative interest rates and sickly growth.

But Europe does have latent manufacturing power. And the world’s second-largest domestic market after the US. It could be well positioned to grow amid the US v. China trade war.

When I lived in Europe, one thing I noticed coming from NZ was that Chinese goods were less common. Many of the more economic lines of clothing, furniture and other items were made in other parts of Europe.

There remain pockets of low-cost manufacturing plus factory capacity across the continent, ready to assist in the world’s demand for goods.

So in our global investing newsletter, Lifetime Wealth Investor, we’re showing Kiwi investors where we see global market opportunities. And how to take advantage of them.

As I write, our suggested portfolio is climbing nicely while paying dividends.

Do check us out by clicking here.

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.