Want to retire in your 30s?

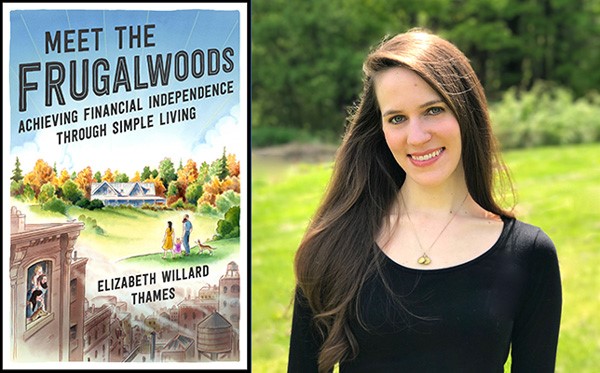

I just finished listening to the audiobook version of Meet the Frugalwoods by Elizabeth Willard Thames. While I was weeding my garden…

In 2014, she and her husband mapped out how they could walk away from unfulfilling jobs in a few years. They did it through ‘extreme frugality’. And now live on a rural idyll on 66 acres in Vermont.

As I was listening, I cut back the ivy a bit more than usual.

Like many in the FIRE (Financial-Independence-Retire-Early) movement, the route to success is paved with pandemic penny-pinching.

Sure, you can build up a stash to invest. But to my way of thinking, it sucks.

Mrs Frugalwoods stopped buying make-up, new clothes, had her husband cut her hair, bought used furniture strangers had sat all over, and funnelled money into index funds. While doing all her own home renovations.

The trouble is, if all 30-somethings adopted her process, the economy would grind to a halt. Especially furniture makers, hair salons and renovators.

A bit of thriftiness is to be celebrated. But extreme frugality where you can’t even go out for coffee and cake?

One of the simple joys of earning, saving and investing is to have a bit more to spend tomorrow. On some smooth new clothes. A trip away. A nice bottle of wine. Alongside some financial independence.

So are the two mutually exclusive? Do you really have to live like hippy monks in the woods to get ahead?

No, you don’t. Assuming you’re able to save something, the key is to invest in assets that provide immediate yield.

Mrs Frugalwoods seems to favour index funds. And retirement programmes such as 401k which generally start to become accessible without penalty at 59½.

Like KiwiSaver — accessible from the age of eligibility for NZ Super, currently 65.

Trouble with these is they’re lock-ups.

Sure, you get the benefit of your proceeds compounding over years. Plus, employer and government contributions. That’s great for a lot of people. But, there’s no extra income from your efforts now. You’re no better off until you hit the magic age.

And who knows what sort of condition you’ll be in then. Or who you’ll have around to share things with. Or whether the government might move the NZ Super eligibility age out a bit more (and the KiwiSaver payout age with it).

In my book, investment of funds should yield some fun. Fun in researching and choosing your investments. And fun in some yield dollars to spend. Sooner rather than later.

Now, dividend-paying shares can be a good option. There’s usually a trade-off, though. A great dividend yield — 7%, 9% or more — can mean the company doesn’t offer much in the way of capital growth. Sometimes. Not always.

And in some cases, the business could be risky — if you haven’t done your homework. That 15% dividend sounds great. But not when it’s only covered for a year, after which the firm might be facing storm clouds.

The key is to find a good business that pays a strong dividend that’s well-covered. And where market outlook alongside dividend policy points to sustainability.

I’ve had businesses in my portfolio that’ve paid 5-7% gross for years on the share price. But since the share price has increased since I bought them, the actual yield on the funds invested could be more than double that.

In fact, I’ll give you an example. Contact Energy [NZX:CEN] has paid an average dividend of 5.6% per annum since 2010.

But in 2010, the shares could be obtained for about $5.80. Today they’re around $8. And they post a gross dividend yield of around 5.8%. Had you bought in 2010, your yield on that purchase price today would be more like 8%.

So $100,000 yielding 8% gives you $8,000 a year gross in extra income — often paid twice a year, or in some cases quarterly. Could cover a nice Hawaii escape in winter. Even after tax. Or a nice leather couch from a local maker — no second-hand Frugalwoods beaters.

And if you’re lucky — or have combined homework with perfect instinct — that $100,000 investment could be worth $130,000 or more some years down the track.

If you’ve chosen the right company, sector and market.

Of course, if the market tanks or the business struggles — it could also be worth less. And dividends can get cut. So you take on some risk.

Still, calculated risk can provide return. Returns that you can use in the future to boost your lifestyle.

In our latest premium newsletter, Lifetime Wealth Investor, we profile dividend stocks that could help you increase your passive income. Access this research here.

Nice book, Mrs Frugalwoods. But I intend to keep the makers of wine, coffee and furnishings well supported — not to mention carpenters and house painters.

In my book, here at Wealth Morning, life is too short for your extreme frugality.

Regards,

Simon Angelo

Editor, WealthMorning.com

Important disclosures

Simon Angelo owns shares in Contact Energy Ltd [NZX:CEN].

Subscribe Now

Subscribe Now Login

Login Managed Accounts

Managed Accounts Quantum Wealth

Quantum Wealth

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.