You’d have to be pretty unlucky not to be making money in the market right now.

And when I say ‘market’, I mean ‘markets’ — plural.

Because it’s not just one market on the up, it’s all of them. All at the same time…

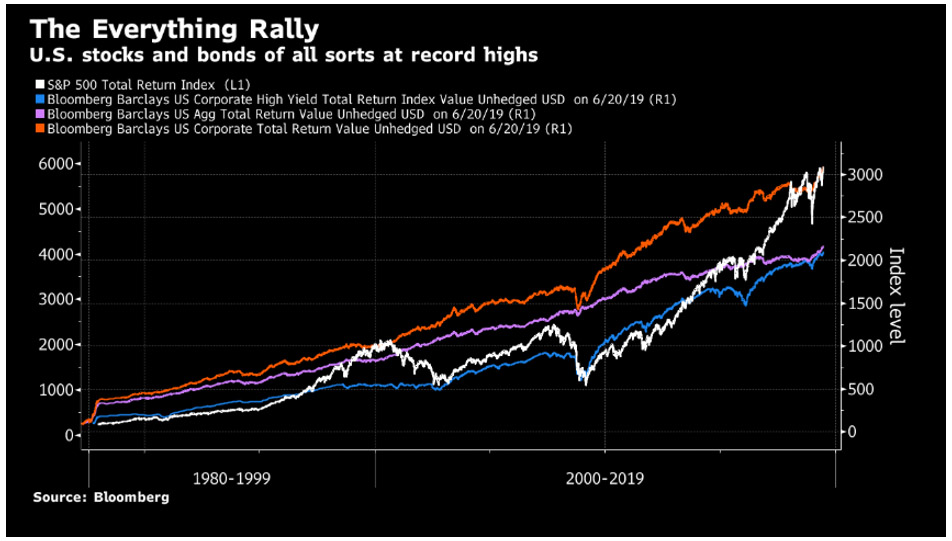

Take a look for yourself:

This chart shows the total returns for the top 500 stocks in the US, corporate bonds — loans to big companies, high yield bonds — riskier loans, and sovereign bonds — loans to countries.

All are trending higher.

Gold, tech stocks, miners and financial services are too.

It’s an unprecedented ‘everything’ rally.

Bulls are making money; bears are making money. Everyone makes money in the everything rally.

So, what the heck is happening?

And why is one strange opportunity the perfect place to see out these even stranger times?

That’s where we’ll dare to tread today…

Rate cuts are the cause for the ‘everything’ rally

First, the cause…

It’s pretty obvious: Lower interest rates.

Everyone’s at it.

Mario Draghi of the European Central Bank recently said that further rate cuts remain ‘part of our tools’ and that ‘in the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required.’

The US Federal Reserve stated last week that because of ‘uncertainties’ they would ‘act as appropriate to sustain the expansion’ in the coming months.

The market heard: ‘Yee-ha! Interest rate cuts are a-coming.’

And our own RBA joined in the fun, saying:

‘It is not unrealistic to expect a further reduction in the cash rate as the [RBA] board seeks to wind back spare capacity in the economy…’

This expectation that interest rates are going to fall to super low levels is driving the value of everything up.

Of course, stock investors love hearing that…

For them, they think rate cuts will stimulate the economy. That’s good for company profits and share prices.

On the other hand, the worrywarts think that these crazy low rates are a sign of impending doom.

And for them, bonds and gold become a lot more attractive ‘safe havens’ to park their money. That increases demand and pushes up the price of safety.

One root cause; two opposing conclusions.

Who’ll end up right?

Both, probably…

In the short term, we might see an eye watering melt up rally as central banks throw everything at the economy.

But in the long term, it probably won’t end well. It never does. But that could be years away.

Like it or not, as an investor this is your shot right now.

Join in the melt up madness or the crazy doomsday preppers!

What to do?!

Well, what if I told you there was one investment that might benefit no matter what happens?

It’s fast becoming the new ‘gold’. And yet it has all the technological potential of the fastest growing Nasdaq stock.

It’s also the best performing asset this year, too.

What is it?

Let me tell you… [openx slug=inpost]

Digital gold with a technology twist

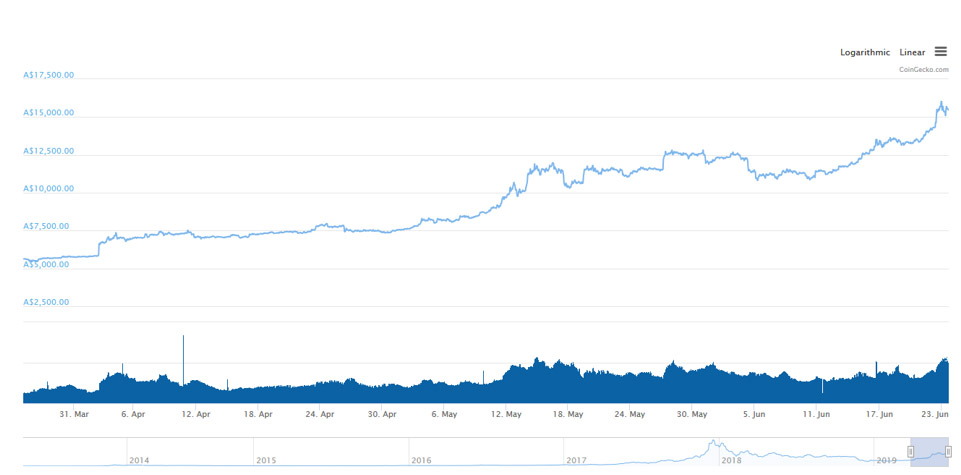

Check out this chart:

This chart is the bitcoin [BTC] price.

It’s going ballistic right now and is up from AU$5,521 to AU$15,518 in just the last three months.

Sure, you might think I’m a bit a crazy to even suggest bitcoin as a potential ‘haven’ asset.

And for the sake of clarity I’m certainly not saying it is…yet, anyway.

Bitcoin is very risky and there’s lot of uncertainty about its future.

But what I am saying is that it could evolve to become that. And perhaps we’re seeing the early stages of this playing out now.

Here’s my thinking…

I’m going to presume you have at least an inkling of what bitcoin is.

For the purposes of today, you only have to understand two main things.

The first is that the supply of bitcoin is limited.

There will only ever be 21 million bitcoins. The smallest unit of bitcoin you can own is one Satoshi. That’s 0.00000001 BTC.

Compare bitcoin’s limited supply to a world where central bankers are churning out more and more money every day.

Bitcoin is a relative oasis of monetary certainty.

The fact is, every country in the world today is trying to devalue their own currency.

In countries like Switzerland, they even have negative interest rates to keep pressure off the Swiss Franc.

Mull over that for a second: In Switzerland, you have to pay the bank to store your money!

All this madness could be coming to an economy near you soon.

On the other hand, you don’t have to pay anyone to store your bitcoin. And no one can charge you or force you to do anything with it, if you don’t want to.

I think we’re in the first stages of investors starting to see bitcoin as a more reliable alternative to fiat currencies.

But cryptocurrencies are not purely a defensive asset.

They’re also a technological innovation that could change the way the world works.

There’s a lot to it, but for the purpose of today, it boils down to one simple thing.

Crypto makes lots of ‘middleman’ roles redundant.

Think banks, think administrators, think exchanges, think brokers, think data aggregators, think lawyers, think accountants…there’s almost no industry where a decentralised version using cryptocurrencies can’t improve upon the status quo.

It’s as big a change as the internet was two decades ago. Perhaps bigger.

Of course, it’ll take time for the technology to get right.

But the genie is well and truly out of the bottle. And thousands of the brightest minds in the computer science are working on it.

Even companies like Facebook are now jumping aboard…

Bitcoin appeals in both boom and bad times

I think no matter how this ‘everything rally’ ends, bitcoin has a role to play in an investor’s portfolio.

It has features that appeal in both boom times and bad times.

But even more than that…

We could be living through a messy stage in the evolution of money, a rare though not uncommon event.

Money does change from time to time.

From salt and shells, to metals and gold, to fiat paper, to binary digits on a central computer ‘somewhere’.

Decentralised digital cryptocurrencies are the natural successor.

With hindsight, we might look back and see that this was actually be the biggest shift in monetary power the world has ever seen.

I could be wrong about all this, of course.

But whether you’re a crypto sceptic or not, in my opinion, you’d be silly not to consider having a (very) small stake in bitcoin.

Just in case I’m right…

Good investing,

Ryan Dinse

Ryan Dinse is a contributing editor at Money Morning New Zealand. He has worked in finance and investing for the past two decades as a financial planner, senior credit analyst, equity trader and fintech entrepreneur. With an academic background in economics, he believes that the key to making good investments is investing appropriately at each stage of the economic cycle. Different market conditions provide different opportunities. Ryan combines fundamental, technical and economic analysis with the goal of making sure you are in the right investments at the right time.