Have you ever attended an investing workshop?

If not, I’d highly recommend it. I’ve been to dozens…and I always get something new out of each one.

Mostly, I like to go to hear the different takes that the presenters have on the market…because invariably, they’ll inject their own perspective into the presentation.

I recently attended an intro-to-investing workshop and heard something that bothered me.

The presenter, who is a bigwig money manager at a major NZ financial firm, included a section in his slides called ‘Bad News Sells’.

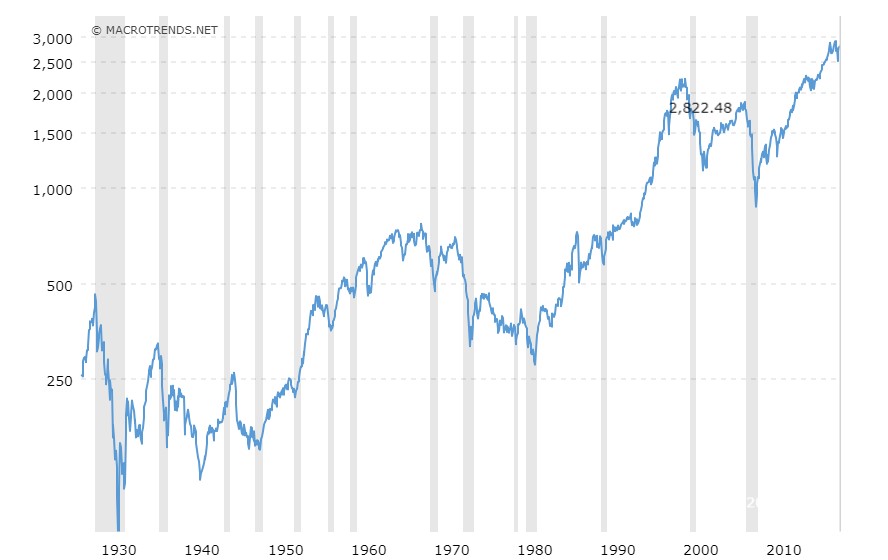

He proceeded to show a graph of the S&P index over the past 40 years…and how it’s mostly gone up.

And along the timeline, he listed bearish predictions by well-known analysts and economists…and then pointed out how they were proven wrong over the weeks after the prediction.

Many of those analysts and economists are people that I work with. People I’ve met on many occasions and have come to respect. And I know, from talking with them, that they’re bearish because they believe in the business cycle and recognise the economic signals that are blinking red.

They’re not fearmongers.

Not in the least.

In fact, almost all of them have businesses around stock investing — whether active money management or paid stock research — so they have skin in the game. They want a bull market just as much as the next guy…but they feel responsible to share both sides of the coin.

As I’m listening to this presenter speak, it dawned on me how ridiculous it is for him to say ‘Bad News Sells’.

He makes money by persuading rich folks to trust him with their wealth. His entire livelihood revolves around convincing people that he’ll provide good returns and security with their savings under his management.

His whole pitch is to assure you that the market won’t crash…that it’s just going up, up, up.

That’s a load of bullish bull.

Markets go up and down.

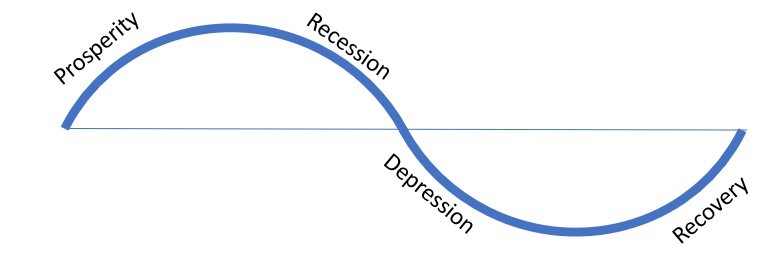

History proves it. Almost anyone with a gram of economic education knows it. It’s called the economic cycle. Here’s how it works:

And here’s what it looks like in real life — the S&P composite over the past 90 years:

[openx slug=inpost]

It’s not as regular as a perfect sine wave…but you can see valleys and peaks. The ups and downs.

The big dips were the Great Depression, the stagflation of 1973-1974, the dot-com bubble, and the Great Financial Crisis. And altogether, there were 14 recessions during this period (look at the vertical grey lines).

So, recessions do happen. It’s a fact. And according to most economists, it’s inevitable.

Think about it like you think about the seasons.

You’re not an ‘optimist’ for expecting warm weather after a cool spring, right? You simply understand that summer follows spring…and does so every year.

Nor are you a ‘pessimist’ if you predict slightly colder and darker days after autumn. That’s just how it works.

Sure, you might not be able to pin down the exact moment the seasons shift, but you can generally predict more warmth around January and more cold around July. That’s a safe bet.

Economic cycles work exactly the same way. You can generally predict a valley to follow a peak. Today we’re peaking…logically, there’s a valley ahead. That’s not ‘pessimism’ — that’s economics.

Of course, the market does go up in the long run. It just takes one glance at the chart above to see that the line generally moves upwards…but there are valleys. And many of them can last over a decade.

It took almost 25 years to recover from the Great Depression. 15 from the stagflation of the ‘70s. 15 from the dot-com bubble.

So it begs the question — if New Zealand faces a recession sometime in the next couple years, how would you fare?

And more importantly, would you be able to wait 10, 15, 25 years for the market to rebound?

Some of you might. I would. That’s why I don’t have a problem getting into stocks, even with a recession around the corner.

But maybe you’re not aiming that far ahead…maybe you’re looking to start cashing out in two or three years’ time…which could be the bottom of a painful recession.

You could see many years of portfolio growth wiped away in just months.

Many Americans experienced that sort of pain 10 years ago. New Zealanders fared quite a bit better…but might have their turn soon.

So, coming back to the investing workshop and the bigwig presenter, I fear that too many people walked away from that event blinder than when they walked in. They might believe that ‘Bad News Sells’…even though it came from a guy who sells good news. It’s scary.

And what’s more is that this presenter was highly credible. He works for one of the largest financial firms in the country…and he stated that his firm serves over 60,000 customers.

That’s a lot of people who might believe what they’re being told — that New Zealand’s economy is bulletproof.

It’s not.

It’s vulnerable.

And so is your money if you’re not being smart and defensive with it.

Best,

Taylor Kee

Editor, Money Morning New Zealand

PS: If you agree that there are dark clouds looming over the horizon, tell me why you think so. I’d love to hear your insight into where New Zealand’s going. And if you think I’m full of it, please tell me that too. Prove me wrong. If you’ve got a good argument, I’ll republish it in Money Morning for your fellow readers to consider. You can reach me at cs@moneymorningir.co.nz

Subscribe Now

Subscribe Now Login

Login Managed Accounts

Managed Accounts Quantum Wealth

Quantum Wealth

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.