Nico’s phone is showing he has a voice message.

It’s his old producer.

‘Hi Nico, I hope your experience in New York is going well. It’s been quite a long time, right? Enough. Well, you could still come back.’

The producer tells him he is still casting for the show’s next season and that his spot is still open if he wants it.

Nico thinks about it.

Nico is a famous actor…in Argentina, where he is from.

He has left fame and success back home to travel to the US to shoot a movie. He is looking for international fame, but also to escape his past.

Yet things haven’t gone according to plan in New York. The movie he came to film has been postponed, indefinitely.

He works as a waiter, and as a nanny. He goes to castings, but no one knows him, or cares about his successful Argentinean career. He hears he is too blond to play a Latin character, but his accent is too strong to play an American one.

While in Argentina he fends off paparazzi, in New York nobody knows him. Nobody is watching him, which leads him to do things he might not otherwise do.

Now his past is knocking at the door.

Should he go back to his old familiar life? Or should he stay?

It’s the premise of Nobody’s Watching, a movie by Argentinean director Julia Solomonoff, which I watched last night.

The movie is about immigration and finding yourself. But it is also about actively searching for change and breaking old patterns.

The only thing constant in life is change

In investment, there is a tendency to think that the future is linear, that things won’t change. A predisposition to keep things comfortably the same and to project what’s already happened into the future.

But, as the saying goes, the only thing constant in life is change. And change is coming. [openx slug=inpost]

Here is what Philip Grant wrote in Almost Daily Grant’s on Tuesday:

‘Change is afoot. Across venture capital, high-end real estate and the retail sector of the stock market, investor behavior has seen a notable shift recently. A trio of sightings:

‘The Wall Street Journal reports today that SoftBank Group Corp. (9984 on the Tokyo Stock Exchange) has been “met with a chilly reception” in efforts to raise capital for a sequel to the $100 billion Vision Fund. […]

‘Last week, The Real Deal reported that Secured Capital Partners LLC., which owns a 157-acre land parcel in Beverly Hills, filed for Chapter 11 bankruptcy protection in Los Angeles federal court. Secured Capital listed the property for a record-breaking $1 billion last summer. Finding no takers, the list price was dropped to $650 million in February. […]

‘The inability of this asset-rich, cash-poor borrower to extend terms on its debts may be a new development in this cycle. […]

‘While the winds seem to be shifting in the V.C. and real estate realms, a key corridor of the economy has fallen into deep freeze, if the stock market is any guide. Thus, independent retail analyst Mitch Nolen notes on Twitter today that apparel retailers have logged a brutal recent stretch, with each of the 24 clothing store stocks he tracks falling last month, with all but three absorbing double-digit declines in May.’

It’s what happens at the end of the boom. During a boom, money flows, there is plenty of liquidity. Once things slow, money stops flowing.

Trade tensions are now rising with tariffs between US and China, and now Mexico.

US Federal Reserve Jerome Powell gave the markets some momentum on Tuesday as he said that the Fed will ‘act as appropriate to sustain the expansion’ if the trade war keeps going.

Many are assuming the ‘act’ will come in the form of a rate cut.

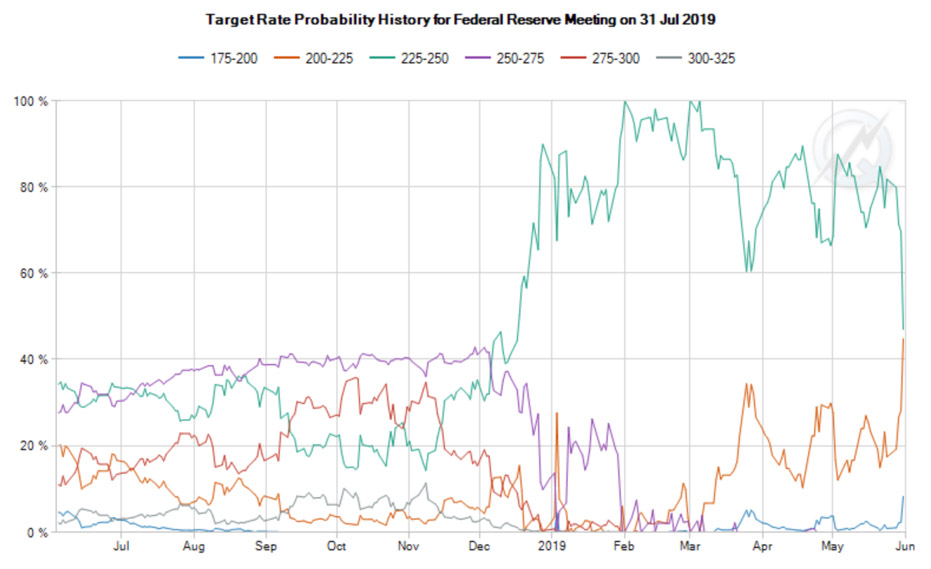

In fact, as you can see below, expectations for a rate cut in July are increasing (brown line) while the idea that interest rates will stay the same is decreasing (green line). This is quite a change from March this year when the probability of a rate cut was close to 0.

The fact that the Fed is abandoning all tightening and hinting at dropping rates is quite significant.

But it could also come in other shapes. Powell also mentioned something else in his speech, something that many media outlets aren’t reporting.

Here is what he said:

‘When policy rates reached the ELB [Effective Lower Bounds] during the [2008] crisis, central banks resorted to what were then new, untested tools to pursue their mandated goals. These tools are no longer new, but their efficacy, costs, and risks remain less well understood than the traditional approaches to central banking. My FOMC colleagues and I are committed to explaining why the use of these tools in the wake of the crisis was a prudent and effective approach to pursuing our congressional mandate and why tools like these are likely to be needed again.[…]

‘Perhaps it is time to retire the term “unconventional” when referring to tools that were used in the crisis. We know that tools like these are likely to be needed in some form in future ELB spells, which we hope will be rare.’

In the last crisis, the Federal Reserve resorted to ‘unconventional’ tools like quantitative easing. Now they are abandoning tightening to increase liquidity…and these unconventional tools may become the new normal.

The thing is, as Powell mentioned, these are ‘less well understood’.

That is, we don’t really know what we are doing, and we are in a huge experiment. We don’t know what the results will be.

But we do all this to keep fake growth going and stave away recession.

We do all this to avoid change, to keep things the same.

Meanwhile, gold is rising.

Best,

Selva Freigedo