Japan…growing…now I’ve seen it all.

Abenomics managed to lift Japan’s economy 2.1% in the first quarter of 2019.

Yet few were impressed. Imports fell hard, as consumers cut back on spending. Exports, which drive Japan’s economy, didn’t improve all that much either.

Oh and guess what? If Japan’s household budgets weren’t stretched enough by debt, higher taxes are coming soon.

Yes…the people suffer so the government can pay down their humungous debt burden.

Few seemed to worry, though.

Investors are more concerned about which overpriced tech stocks they should buy. Our own tech names have gotten an unhelpful boost from the Liberal election win.

Fundies like Magellan continued to back their top performing pick of 2018, Microsoft Corporation [NASDAQ:MSFT]…even though it’s rallied hard.

The one no one wants to touch however, is Tesla Inc [NASDAQ:TSLA].

The stock is down 30% this year as Elon’s biggest fans dump their holdings. Are the wheels finally coming off?

Forget everything you know

A waning Japan. Overvalued tech. Tesla’s decade-long history of losses.

All of this is only possible because of irresponsible money creation.

Interest rates are the blunt go-to tool for central bankers.

Lowering interest rates is thought to encourage borrowing and investing, spurring on growth. Increasing rates is thought to have the opposite effect.

Of course, this relationship is just assumed. No one is actually checking whether there is a strong relationship between the two or not (interest rates and economic growth).

It seems so logical, though. If the price of money (interest rate) falls, why wouldn’t borrowers take advantage? Why wouldn’t companies borrow to invest, employ and spend?

Yet if the academics have found anything, it’s that interest rates have little bearing on growth at all.

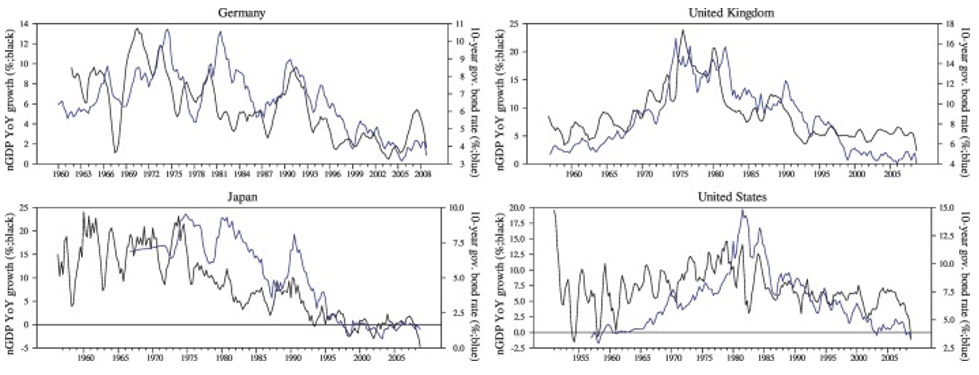

In his 2018 Reconsidering Monetary Policy paper, Richard Werner finds the relationship between interest rates and growth is actually positive…meaning interest rates and growth move together.

In a talk at South Hampton University, Werner summarises his findings as:

‘If you look at the data what you find is…a positive correlation. So, more growth goes hand in hand with higher interest rates…Look at the leads and lags which one comes first?

‘The official story is rates happen first, they move the economy. The economy follows on the action of the rate.

‘Well, the empirical evidence shows…the timing the other way round…interest rates follow the economy.’

It’s why Japan, with negative rates, has had such a hard time growing. Lowering interest rates will do little to nothing if people aren’t going to borrow.

In fact, perceptions of risk likely have a far bigger impact on growth in many situations. I’ll let another academic, Bruce Greenwald explain:

‘All the empirical evidence we have is that interest rates within the range of variation we see do not affect investment. Investment is driven by perceptions of risk and accelerators in demand that drive the demand for investment.

‘So it’s not a surprise I think that the zero interest rates have not stimulated investment. Because nobody has ever been able to find a significant interest rate effect on investment.’

Of course, Japan has other structural problems too. Being a manufacturing-led economy, their locked into global competition, which might turn out to be unprofitable in the long run.

So, what happens next? What do they do when low rates don’t work?

They pull out another tool to mutate financial markets. [openx slug=inpost]

Central banking folly

When low rates don’t work, central banks flood the system with liquidity. They create money (out of thin air) and buy financial assets. Usually they buy bonds.

This is what it means to initiate quantitative easing (QE).

Central banks create money and buy bonds from financial entities like insurance companies or investment banks. The idea is that if financial assets rise, the owners of those assets feel wealthier, much like those Aussies holding property leading up to 2017.

With their new-found paper wealth, they might go out and spend more. But that’s not really what happens.

More often than not, this new money gets trapped in financial markets. While bond holders are happy to sell out for a gain, they see other assets like stocks rise and pile their profits right back in.

What do you think everyone else does when they see this? Like those that piled into bitcoin in 2017, no one can stand to sit on the sidelines and watch prices rise.

So they too jump into the speculation game.

This is how Tesla has been able to fund a decade of losses. There’s eager money looking to make a quick buck in bonds and stocks.

It’s also why tech stocks have flown so high.

Fundies are flushed with cash. Prices, generally across the board, are high. The only stocks with enough growth to justify those prices are tech stocks, names like Amazon.com Inc [NASDAQ:AMZM] or Microsoft.

Thankfully, central banks have hit the brakes on QE. Low interest rates persist, though.

Maybe even an Aussie rate cut is on the cards. Greg Canavan over at The Rum Rebellion wrote yesterday:

‘Legislated income tax cuts are due to kick in next financial year, which will provide some relief to households. As I’ve asked previously, does the RBA really want to expend all its interest rate ammo when the economy is still muddling along and commodity prices are high?

‘I believe it is less keen to cut rates than market commentator’s hope.

‘Then again, maybe that’s wishful thinking. They are central bankers, after all.’

Hopefully it doesn’t come to that. But if it does…don’t be surprised if stocks drift above the waves for that much longer.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.