China wants a deal, Trump can smell it!

It’s why they’re printing yuan in the billions and pushing it out into the system.

The Chinese are creating liquidity. It’s a cash buffer for businesses hurt by tariffs.

But Trump can keep this up for years potentially. Liquidity can only last for so long, until bad debts catch up that is.

It’s only a matter of time now…

I guess that’s why Trump keeps hinting a deal could be signed at any moment. His positivity is momentarily keeping stocks up.

Investors couldn’t bear to think of things getting worse. So they won’t.

But we see what Trump’s doing. He knows he can move the market. And the only direction he wants it to go before his potential re-election is up.

Too bad hedge funds aren’t on his side anymore…

It’s obvious by now

As time goes on, investors are starting to wake up. We’re starting to understand what Trump is actually doing.

I’m sure initially investors thought Trump was crazy…

Yes, the US buys more from China than they buy from the US. But that’s how it is for a lot of US trade relationships.

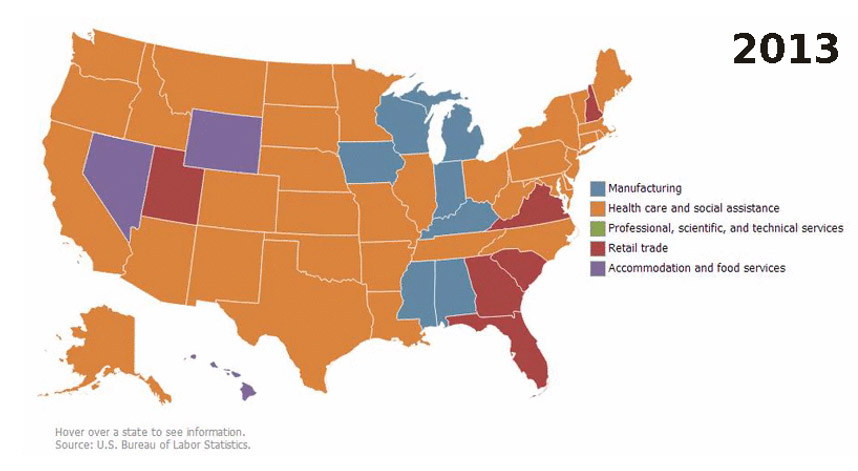

The US is wealthy. US households consume far more than most. Manufacturing is largely offshore. Where are Americans going to buy their goods? Obviously offshore.

The US is also a service dominated country.

Services tend to be local in nature. You’re not heading to China for a haircut or Germany to see your GP.

What this means is the US imports a whole lot, and has few goods to export.

So why put tariffs on China for something that’s happened naturally (although there is some debate as to whether this was a natural transition)?

Is it just a politic cover? Is Trump complaining about US jobs and the trade deficit to stir up emotions and win votes?

Absolutely!

But there’s something else. Trump is finally doing what few American presidents have done before him. He’s challenging China on one of their most heinous practices — forced technology transfers, usually through some joint venture partnership.

And his tool for that end has been US dollars.

China needs dollars, after all. With US dollars, China can prop up the yuan while also printing more money. The latter should devaluate the currency. Yet because China uses USD to buy yuan, their currency doesn’t depreciate all that much against a basket of goods and services.

US dollars are also used as a reserve asset —the money which banks hold back, that acts like ‘just in case’ money. With more dollars in the kitty, Chinese banks can create more yuan and lend more to increase industrial output.

USD is also useful to buy stuff China needs. Stuff like barrels of oil and tonnes of iron ore.

Starving China of these dollars seems like a pretty good idea. And more than a few hedge funds were betting against China with this in mind.

Yet today, as tariffs increase, the masters of the universe have dropped their bets. They’re no longer betting on a China collapse… [openx slug=inpost]

China bears call it quits

Kyle Bass is the classical China bear.

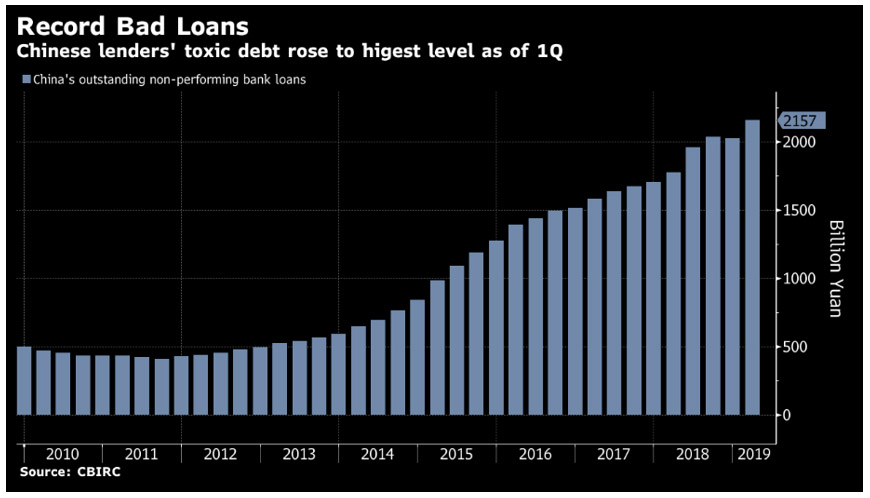

He doesn’t trust Chinese data or statistics, and you probably shouldn’t either. He thinks the banking system is chock-full of bad loans, which is probably a good call…

He also believes China’s dollar gorge can only last for so long. It’s why in 2015, Bass bet against China by shorting the yen.

True, Bass seems like a constant pessimist.

He made big bets against the US housing market before the collapse in 2007–09. He bet against Japan, with their aging demographics, mounting piles of debt and irresponsible welfare system by shorting the yen. The former helped Bass and his fund rise to fame…and to riches.

You’d think Bass would be over the moon with tariff escalations. More tariffs for China means less dollars for China. Bloomberg reports otherwise, though…

‘Long-time China-bear Kyle Bass has closed his nearly four-year wager against the offshore yuan just as the trade war between the U.S. and China is intensifying.

‘Bass’s Hayman Capital Management entered its short bet on the yuan in July 2015. The firm had the position on as recently as March, when Bass argued that China would eventually deplete its $3.1 trillion foreign-exchange reserves trying to support its currency as tensions with the U.S. escalate.

‘…The offshore yuan has slumped about 10% against the dollar in the years since Bass entered the short wager, even after accounting for a 2017 rally of about 7%. Bass said in March that he saw China heading for a painful period of deleveraging after a decade of rapid credit expansion. That process should end with the yuan 30% weaker, he said at the time, echoing a call he’s been making since at least 2016.

‘The Chinese currency has lost about 2.5% this month as the world’s two largest economies trade tit-for-tat tariffs. The U.S. Trade Representative’s office on Monday released a list of $300 billion of Chinese products to be slapped with levies even as U.S. President Donald Trump said he’ll meet Chinese leader Xi Jinping at next month’s Group-of-20 summit.

‘Bass and former Trump adviser Stephen Bannon last month called on Trump to walk away from trade talks with Beijing to achieve better terms later. They were among speakers at a conference in Manhattan.’

And it’s not just Bass. Fund manager Mark Hart also abandoned his yuan short. He held the position since 2009.

But why? Why get out now when things seem to be working against China? Are the hedge funds anticipating a deal, and a stronger yuan?

Maybe.

Trump seems to think a deal is around the corner. If that’s not the case though, guess who might cut interest rates…

I’m looking at you, Lowe!

What this means for Aussies

So far, the Reserve Bank of Australia has taken little notice of the trade war.

But say things get a bit heated, that could all change…we’re a commodity exporting country. Guess what’s going to suffer if China continues to bleed?

Bloomberg points out ‘the impact of the 25% U.S. tariff on $200 billion of China’s goods will be different from the 10% duty — U.S. households won’t be as insulated.’

Maybe ‘less than 60 Chinese exporters out of nearly 1,000 firms could absorb 25% tariffs.’

‘If Chinese producers can’t absorb the higher tariff, the cost will have to be passed to U.S. consumers. The higher tariffs also give U.S. producers greater pricing power, which may increase the cost of goods in the U.S. more broadly.’

In this challenging environment, Aussie commodity sales might not be as resilient. And because hiring momentum can mirror exports, guess what happens…

Employment suffers, and Philip Lowe’s got to make a tough decision.

Does he mutate the lending market further by lowering interest rates and accept the implication for housing and inflation? Or does he hold strong and let Trump and Xi duke it out?

I know which I’d choose…

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.