”How did you go bankrupt?” Bill asked

‘”Two ways,” Mike said.

‘”Gradually and then suddenly.”’

Ernest Hemingway’s 1926 novel The Sun Also Rises

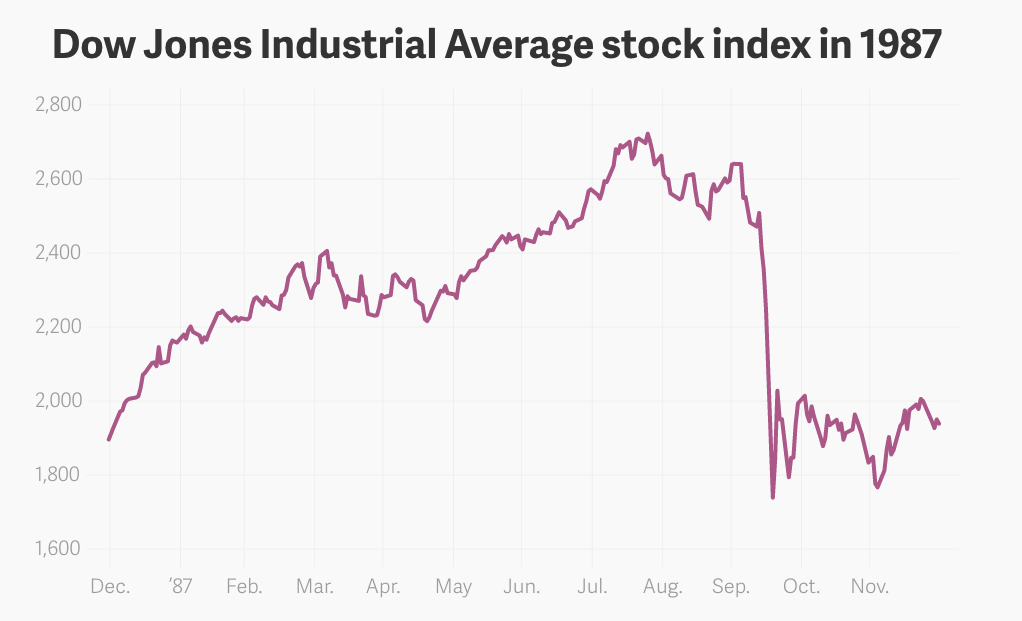

The 1987 share market crash is referred to as ‘Black Monday 19 October 1987’.

For investors in Australia and New Zealand, it was actually ’Black Tuesday’.

We awoke on Tuesday morning to the news that Wall Street had plunged 508 points…a 22% fall in one session.

|

| Source: atlascharts.com |

The chart shows us the Dow actually peaked in July 1987 at 2750 points.

Over the course of the next couple of months, the Dow gradually drifted lower…until 19 October.

Then suddenly it collapsed.

That’s how quickly things can happen.

‘Black Tuesday’ was a baptism of fire for my fledgling financial planning career.

The phones ran hot in the office.

Panicked investors were looking for solace.

Would markets rebound and make their dollar whole again?

When it became obvious that recovery was not going to happen any time soon, the redemption requests came in. Investors exited the market after it had fallen…not before.

The same ‘panic after the crash’ mindset was there in the 2000 dotcom bust and 2008 market rout.

Prior to the collapse, people think they’re going to be smarter than everyone else and hold, hold, hold until the very peak and then sell before the proverbial hits the fan.

Sorry, that’s not how it works in real life. Markets have a way of springing nasty surprises.

The only way you avoid a panicked exit, is to leave well before the sudden collapse.

Yes, you’ll miss out on some gains…but as they say, ‘better to be a year or two early than a day late’.

Thinking you’re smarter than the market is one of the dumbest mistakes people can make with their money.

A bear in the China shop

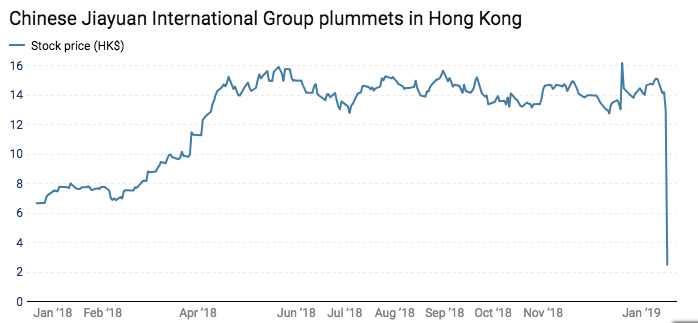

Investors in Hong Kong have just learned how quickly capital can be vapourised with a mood change.

This is an extract from an article published by Bloomberg on 17 January 2019 (emphasis is mine)…

‘A string of Hong Kong-listed stocks plunged without warning in afternoon trading, the latest shock losses to sideswipe investors in the world’s fourth-largest equity market.

‘Jiayuan International Group Ltd., Sunshine 100 China Holdings Ltd. and Rentian Technology Holdings Ltd. fell over 75 percent in a matter of minutes and at least 10 companies were 20 percent lower or more by the close, wiping out HK$37.4 billion ($4.8 billion) in market value. Most of that came from Jiayuan, which lost HK$26.3 billion on record volume.’

The share price chart on Jiayuan International Group Ltd. tells the sad story for investors.

One day your sitting on a stock worth HK$14…and the next it’s closer to HK$2.

|

| Source: South China Morning Post |

Why the sudden reversal in fortune for these stocks?

According to the South China Morning Post (emphasis is mine)…

‘“There is worry that they will not be able to repay the bonds, which triggered fears over default,” said Louis Wong Wai-kit, director of Phillip Capital Management.

‘“[If the company defaults] it may not have money to continue its business. Being a shareholder, you are under risk that the company may go broke,” said Wong.’

Please read and re-read that last sentence. This principle applies to any company that’s borrowed money from yield starved investors in recent years…especially those US corporates — rated one notch above ‘junk’ status — that have issued trillions of dollars in corporate bonds.

If the company is unable to meet its debt obligations…then shareholders can look forward to a sudden collapse in value.

The South China Morning Post expanded on what’s really troubling investors (emphasis is mine)…

‘“The market is worried about the liquidity situation among mainland Chinese property stocks,” said Kenny Tang Sing-hing, chief executive of China Hong Kong Capital Asset Management.

‘Many of the developers have taken on massive debts to fuel fast project development and sales, while home prices have stalled across China as government cooling measures took effect.’

The story of boom and bust never changes…just the actors.

In 1987, it was the new breed of entrepreneurs who’d taken on too much debt.

Everything is good until it’s not.

Of course, the company says it’s still good…

‘Jiayuan said in a statement that it had already repaid the debts. “[The company’s] current financial situation is healthy and its business operation is normal,” it said.’

But is it?

China, the global growth engine of the past decade, is slowing…under the weight of debt, trade war and that other indisputable force…trees do not grow to the sky.

Here’s a few early warning signs

According to Tech Investor News…

‘Nidec, a Japanese company with $14 billion in revenues last year, makes a wide range of electric motors, from tiny devices that make the iPhone vibrate to industrial motors. It’s the world’s largest manufacturer of motors for disk drives. For the automotive industry, it makes things like engine and transmission oil pumps, coolant pumps, control valves, and fans and blowers. It makes motors for industrial robots, etc.

It’s a supplier to Apple, other electronics makers such as hard-drive makers, but also appliance makers, automakers, robotics manufacturers, industrial equipment manufacturers, etc. In other words, the company is a key supplier of advanced parts to Chinese factories.

On 17 January 2019, the Nikkei Asian Review reported that Nidec had just issued a significant profit downgrade …

‘Taiwan Semiconductor Manufacturing Co. [TSMC], the world’s biggest contract chipmaker and sole supplier of iPhone core processor chips, and Japan’s Nidec, sole supplier of the motor that makes iPhones vibrate when receiving calls or texts, are the latest to deliver downbeat assessments for 2019. TSMC expects a 22% drop in revenue for January to March, while Nidec has cut its full-year profit outlook by more than 25%.

‘We have faced extraordinary changes,” Nidec Chairman Shigenobu Nagamori told reporters at a Thursday news conference as the company reversed a previous forecast of a record profit. The headwinds for business in China turned out to be stronger than expected, with demand for automotive and home appliance motors also tumbling there.’

The Wall Street Journal expanded on the Nidec Chairman’s comments…

‘“I’ve been a manager for almost half a century, but this is the first time I’ve seen such a large single-month drop in orders for us,” said Nidec CEO Shigenobu Nagamori. “What we witnessed in November and December was just extraordinary.”’

The orders fell…suddenly.

That’s how quickly things can change…confidence is a fickle thing.

But Nidec and TSMC are not isolated cases.

Ever heard of Kuka?

Thought not.

Here’s some background from the 29 December 2017 edition of China Daily…

‘German industrial giant Kuka is the world’s largest producer of robots used to make automobiles, with its signature orange cranelike bots a fixture in automated car factories across the globe.

‘Now, this 120-year-old company, which in January [2017] became just under 95 percent owned by China’s Midea, the world’s largest appliance maker, is aiming to pull off a big transformation that, if successful, will take it into faster-growing robot markets.’

This 10 January 2019 announcement is from Kuka’s website (emphasis is mine)…

‘On January 10, 2019, the Executive Board decided in the context of the preparation of the financial statements 2018 to re-adjust the Guidance communicated in October 2018 for Fiscal Year 2018 (sales revenues of approximately € 3.3 billion and EBIT-margin of approximately 4.5% before purchase price allocation, growth investments and reorganization costs). The reasons are primarily that the company is being affected by a stronger slowdown in the automotive and electronic industry in the fourth quarter 2018, ongoing uncertainties in the Chinese automation market and negative impacts from the project business.’

In the space of a few months (from October 2018 to January 2019) Kuka has needed to ‘re-adjust the Guidance’ on revenues and EBIT margin.

Why?

China is slowing much faster than expected

Things can continue, until they can’t.

China has followed the Western economic model of borrowing its way to prosperity.

As we’ve seen with all previous busts, there’s always a point where debt limits are reached — even for China — and then suddenly the market reacts.

With or without trade wars, China is going to hit a wall.

It simply has too much unproductive debt…propping up a giant property Ponzi scheme.

When the proverbial hits the fan in China, you can be assured it’s going to be flung across every other nation…especially Australia.

Those who think they’re smart enough to get out just before this happens are deluding themselves.

The ride down can be so swift and sudden, you’ll not know what hit you.

Regards,

Vern Gowdie

Vern Gowdie has been involved in financial planning in Australia since 1986. In 1999, Personal Investor magazine ranked Vern as one of Australia’s Top 50 financial planners. His previous firm, Gowdie Financial Planning, was recognized in 2004, 2005, 2006 & 2007, by Independent Financial Adviser magazine as one of the top five financial planning firms in Australia. He is a feature editor to Money Morning NZ and is Founder and Chairman of the Gowdie Family Wealth and the Gowdie Letter advisory services.