Renters in Mount Maunganui are complaining that they’re being kicked out of their rental properties to make room for Airbnb guests.

Shilo Kino, a journalist for the New Zealand Herald, recently reported that locals are whining that ‘this whole town has become one big Airbnb’ and that renters are being ‘forced out’.

Sure, a shortage of rental properties is annoying…but don’t blame the homeowners.

An Airbnb host in Mount Manganui revealed how the two situations stack up.

With long-term renters, her apartment would run for $800 per week…and would likely be filled by two couples. With at least four people living in the apartment full-time, there’s generally more wear-and-tear than if it was just short-term guests popping in and out.

With Airbnb, she can charge $200 per night…or $1,400 per week in the summer months. $100 per night in the winter. If she wants, she can block off certain days for friends and family to use the house…or if she wants to make a renovation.

More money and more flexibility…it’s what most anyone would do, right?

As you’d expect, more and more homeowners in the area are opting for the Airbnb model over renting…which pushes renters out into the suburbs…or out of the area altogether.

Now, the local council aren’t sure how to handle this. They feel like it’s their responsibility to fix the situation (Instead of letting the market find an equilibrium).

So the rumour is…they’re considering a bed tax, like Auckland recently enacted.

From an economics perspective, that’s a disastrous move, especially for a seasonal economy like the Mount. Here’s how the cause-and-effect would work…

If you charge Airbnb hosts a bed tax on each night they rent out, they’ll make less or raise the price of their unit.

If they make less, maybe they stop hosting…

Which shrinks the supply of holiday accommodation…

Which increases the average price of visiting…

Which could decrease the flow of tourists…

Which would hurt the sales of local businesses…

And, finally, would shrink the local economy…

And if the hosts raise their prices, the same thing would happen — less visitors and less tourist dollars spent in the city.

The only ‘winner’ in this scenario is the council, because they suddenly get a huge influx of tax revenue without doing anything.

But even that wouldn’t last long…as you see above.

Renters might have more options for a while, but homeowners could do the cost-benefit analysis against hosting on Airbnb…and would eventually raise rents to match what they could make with Airbnb.

So a bed tax wouldn’t really solve anything…nor would it help anyone besides the council.

It would be what economists call a ‘contractionary measure’ — meaning a policy that results in the local economy becoming worse off.

The best thing the council could do is keep their hands out of the cookie jar.

Let the market sort this one out…

[openx slug=inpost]

You’d eventually experience growth in the suburbs as more working folks move away from the unaffordable city centre…

We’ve seen an extreme example of this happening in Nelson in the past few years.

|

Source: Taylor Kee |

QV reports that the average residential land value in Nelson has skyrocketed 48.5% in just three years.

And in the surrounding towns, the average dwelling value has followed suit. Here’s data for the three years leading up to September 2017.

|

Source: Stuff.co.nz |

Ideally, these abnormally high prices would attract new construction…increasing the supply of housing…and pressuring prices downward over time.

But, as we all know, that’s easier said than done here in New Zealand.

Residential construction simply can’t keep up…

We could analyse that further and say that there’s a shortage of qualified construction workers to propel the industry…

Which we could then blame on either a restrictive immigration policy, which would prevent construction companies from bringing in the help they need…

Or it’s a lack of domestic interest in becoming a tradesman…

Maybe a bit of both.

But here’s what we’ll say — raising costs through new taxes and fees is absolutely not the way to solve the problem.

It only makes things more expensive. If anything, taxes and fees are key drivers in fuelling the flame.

From an investor’s perspective, there’s certainly an opportunity here.

We see a hole in the market — not enough houses.

There are companies that can fill that hole — residential construction firms.

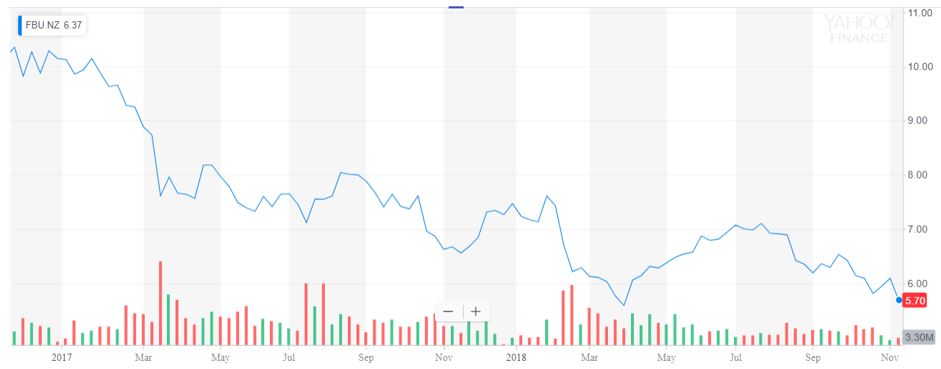

But on the NZX, there’s only one listed stock to consider — Fletcher Building [NZX:FBU].

And we’re not so sure that would be a wise investment right now…

There are heaps of internal issues within the company, including mismanagement, poor business practices and significant liabilities that give us pause.

Its stock has seen a rough tumble consequently. Over the past two years, it’s nearly halved.

|

Source: Yahoo Finance |

It seems to us at Money Morning New Zealand that the market is favourable for a new contender to enter the ring.

We’d love to see a residential construction firm with the cojones to list on the NZX next year.

There’s ample opportunity for scalable growth throughout New Zealand…and if they need capital, I’m confident there would be a long line of Kiwis eager to invest.

But they’d need to learn from the mistakes that Fletcher made…or Ebert or Hawkins…and put a strong emphasis on risk management.

And the government would also need to do their fair bit and fix their broken regulatory landscape for this sector and the labour flow it requires.

If these stars align, we could see a superstar construction firm at play…and a massive opportunity for savvy Kiwi investors.

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.