Today, we unveil New Zealand’s $1 billion secret — a shadow economy running right under our noses.

It’s got massive implications for taxpayers…and a twist that involves the RBNZ. But, first, we’d like to welcome New Zealand’s newest ministry.

The Ministry of Housing and Urban Development.

Opening its door this week is the state’s latest attempt to tackle the housing crisis — a whole new ministry.

Not a focus team…

Not a committee…

Not even a reorganised branch of an existing ministry…

…But a total package.

The Treasury suggested that this would cost taxpayers $30 million in operating expenditure over the first four years…plus a few million in start-up costs.

Specifically, Treasury officials noted that the new ministry wouldn’t be taking on any new projects — they’d all be trickling in from existing ministries — but that there’s a whole lot of new overhead necessary for running such a big institution. Stuff relayed the Treasury’s report:

‘The corporate costs of the pre-existing agency will not reduce proportionately to the reduction in their staff numbers. Two agencies have two sets of corporate functions, e.g. a Chief Executive, IT, or a core HR department.’

In other words, the new Ministry of Housing and Urban Development will be doing the same things with the same people that other ministries have already been doing…but with a multimillion-dollar overhead bill.

But if Phil Twyford wants his own ministry…then by golly, he’ll have it!

Back to the shadowlands

Unlike Twyford’s overt claims to power, New Zealand has a problem with a covert economy.

It’s known by many names: The Shadow Economy, The Grey Economy, The Black Economy, The Cash Economy, The Informal Economy, and of course, its real definition — tax evasion.

That’s right. If you weren’t already aware, there are heaps of Kiwis who are paid in cash and never report that to the IRD.

It could be that tradie who offered to fix your deck for a hundred in cash…

Or that barista who prefers you to not pay with a card…

Even that grandmother who pays her grandson $20 to mow the lawn…

It’s not the act of paying that’s the crime. Nor is it the use of cash. But it’s the service provider hiding that income from the taxman that could result in jail time.

Of course, it wasn’t that long ago that we paid for everything with cash. It was the norm…and you probably wouldn’t connect it to criminal activity.

But today, in the era of mobile payments, credit cards, and bank transfers, the use of cash can carry a bit of a negative connotation. [openx slug=inpost]

Should cash be outlawed?

John Cuthbertson of Chartered Accountants Australia and New Zealand seems to think so.

He told the NZ Herald:

‘Under-reported income, manipulating your expenses and slipping a tradesman some bank notes, is not okay. It’s not a victimless crime. There’s a cost to this behaviour and that cost is less money for health and education, social housing and the huge range of government services in need of more money.’

Very persuasive. If I had only known that there’s a ‘huge range of government services in need of more money’, I would have been happy to fork over my hard-earned dollars.

Maybe it could go towards the new Ministry of Twyford!

But, seriously, there’s a growing sentiment against cash. I’ve tracked that story around the world:

- Sweden — Banks are removing ATMs throughout the country.

- South Korea — Aiming to eliminate paper bills by 2020.

- France — Could ban cash for transactions over €1,000.

- Australia — Considering ditching the $100 bill.

- Greece — Citizens must declare cash holdings over €15,000.

And the most dramatic effort in the war on cash has been India’s.

Two years ago, the prime minister suddenly demonetised their two biggest bills. And it left the country in a frenzy. Only 50% of Indians had bank accounts…meaning 600 million people suddenly had to exchange their cash holdings for lower denomination bills…or risk punishment.

Some people never got to exchange their cash…so their savings became worthless.

In fact, there were over 100 deaths reported due to the demonetisation effort. A few suicides. Lots of older people dying as they waited in bank queues.

It was a fiasco.

But it just goes to show the great lengths that governments are willing to go to get rid of cash.

Because they need every penny of tax revenue they can scrounge up.

Conspiracy at the RBNZ?

Curiously, our friends at Interest.co.nz noticed an anomaly in an RBNZ report on cash. They found that the number of banknotes in circulation followed a certain trend…until about five years ago.

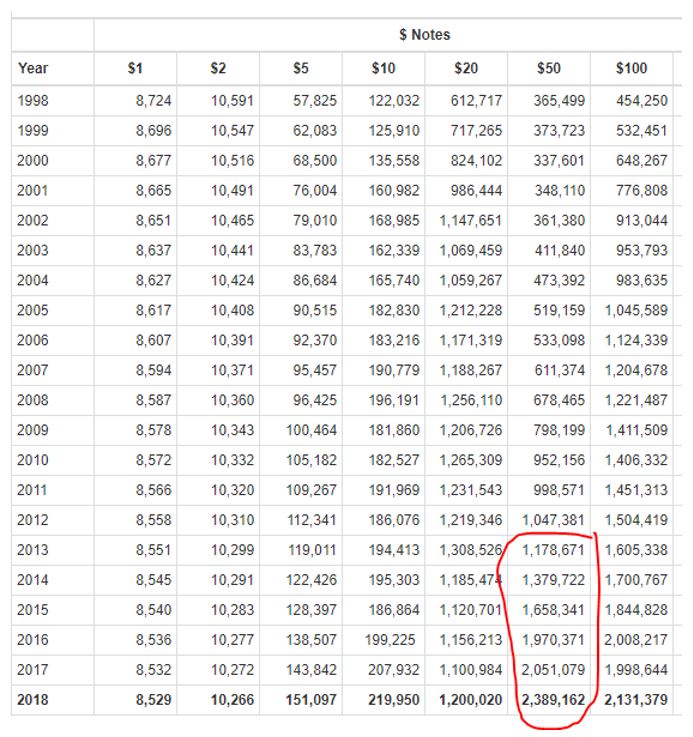

For some reason, the number of $1, $2, $5, $10, $20 and $100 bills have stayed steady, but the number of $50 notes have skyrocketed. See below:

|

Source: RBNZ |

Curious, indeed. The number of $50 banknotes has doubled in the past five years.

But just the $50.

And how is the RBNZ — New Zealand’s sole issuer of currency — involved here? What’s their angle?

Because, for the most part, we’re seeing countries trying to slow cash production down…in lieu of digitally-held funds.

But the RBNZ is going the opposite route — injecting more large-denomination bills into the system.

When experts like John Cuthbertson suggest that the state is losing over $1 billion to the informal cash economy, you’d think the state would be diving headfirst into the war on cash.

Frankly, I’m not sure what to make of it. I have a suspicion, but I’d like to investigate it more deeply before throwing it your way.

In the meantime, let me know if it makes sense to you and why?

Clue me in at [email protected].

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.