Some like to talk about their favourite sport teams. Others like to talk about their favourite era in history.

I like to romanticise great businesses.

And Amazon.com, Inc. [NASDAQ:AMZN] has definitely been one of those over the years.

Who would have thought Amazon, an online book store, would be what it is today. Below is just a snap shot of some of the businesses Amazon owns.

|

Source: Visual Capitalist |

Were online books so profitable that they were able to fund the conglomerate that is now Amazon?

Not really.

But it was a platform on which Jeff Bezos built his vision. Making everything convenient and cheaper for customers.

This doesn’t lead to profits immediately. Early on, Amazon was losings millions of dollars. Profits have only just started to emerge. But the company still operates on an extremely thin margin.

The amount of sales that turn into profits is only about 1.7%.

And this is below what it was 10 years ago.

So why does the Everything Store trade on a 173 PE?

Why does Amazon’s stock trade 400-times earnings?

You don’t pay for what has happened; you pay for what could happen.

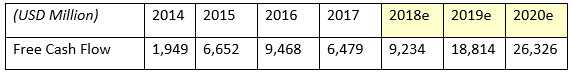

The Amazon model has worked wonders for sales growth and free cash flow. This is the amount of cash left over after all the expenses to maintain fixed assets.

Think of it like the left over money Amazon has to reinvest in new projects.

|

Source: Bloomberg |

In just the last few years, free cash flow has exploded. And it’s not expected to slow down either.

Why? Because Amazon has a vision. Wherever they can make things easier for customers, they’re probably going to do it.

And so far, they’ve been able to roll out this model over multiple industries. Why would the next few years be any different?

However, don’t take this as a plea to buy Amazon stock. Even with free cash flow of US$26.3 billion, the stock is trading at 35-times 2020 figures.

Instead I want to show you how a few tech companies are following in Amazon’s footsteps. No, they’re not going to compete with Amazon head to head, although they may one day.

Like Amazon, these tech companies trade on lofty multiples, not because of current earnings, but because investors believe in their vision.

Tech companies infinite potential…

Political tensions have done nothing. Data breaches, currency devaluations…nothing is stopping this bull run.

The top 500 Aussie companies are up (collectively) more than 3% this year. The top 500 US companies have climbed more than 6%.

OK, so it’s nothing that will blow your socks off. But you would think at some point this bull market has to come to an end.

For almost 10 years we’ve not seen any short sharp falls, which litter bargains all over the place. In fact, it would seem the expensive stocks (based on PE multiples) are just getting even more expensive.

Two that come to mind are printed circuit board design company, Altium Ltd [ASX:ALU] and software logistics company, WiseTech Global Ltd [ASX:WTC].

Wednesday this week, both tech stocks release their full year results to the market.

For Altium, sales were up 26%, with profits climbing 32%. WiseTech saw sales rise 44% and net profit increase by 28%.

Safe to say this is amazing growth.

But are they really worth a 33% and 35% rise in the stock price? Remember these are billion dollar companies.

I’ll let you decide that for yourself. But thanks to fast double digit appreciation, Altium and WiseTech now trade on PE’s of 83 and 176.

Now, for most investors a PE of 30 is a bit much, let alone more than 100-times.

But like Amazon, these high multiples reflect what could happen and not what has happened. Both companies have a vision for the future. And judging by the price, investors have bought into both.

Let’s focus on WiseTech for a moment. Reported by The Australian Financial Review:

‘The chief executive and co-founder of the logistics software company said he was aiming to create an international “container chain” that links connecting manufacturers, freight companies, customs, warehouses, trucking operators and last mile transporters.’

What does this mean?

WiseTech is not just a logistics software company. From what I can tell, they want to be a part of the whole process: from building something to getting it out to customers.

So…like Amazon, investors are betting on the potential of what WiseTech could be and what they could create.

Whether these investments pay off remains to be seen. But it will be interesting to watch these tech companies evolve into so much more.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.