Prime Minister Jacinda Ardern took back the reins yesterday.

Like a mum who’s just come back from a trip away from home, the kids run happily into her arms while dad lets out a sigh of relief.

Whew. Order again…

Only this time, ol’ Winston Peters feels he did a pretty good job of keeping the house in order.

The New Zealand Herald reports, ‘He announced that he had done very well in the job, that the coalition government had reached new heights of strength and stability.’

Others in the government, including Grant Robertson, Kris Faafoi, Andrew Little and Shane Jones, gave him a 9/10, 11/10, 9/10 and 10/10 respectively.

A+, Mr Peters!

Mike Hosking stated, ‘He hasn’t got himself into any major scrapes, with the exception of the deportation business and the flag, both of which he chose to fight on.’

Just the deportation business and the flag. Not bad for six weeks at the helm.

Compared to Trump, Peters is an angel…

She’s apples

Speaking of angels, Apple Inc. [NASDAQ:AAPL] has ascended to the heavens.

The biggest company in the world just scraped the $1 trillion ceiling — the first in the world to hit 13 figures.

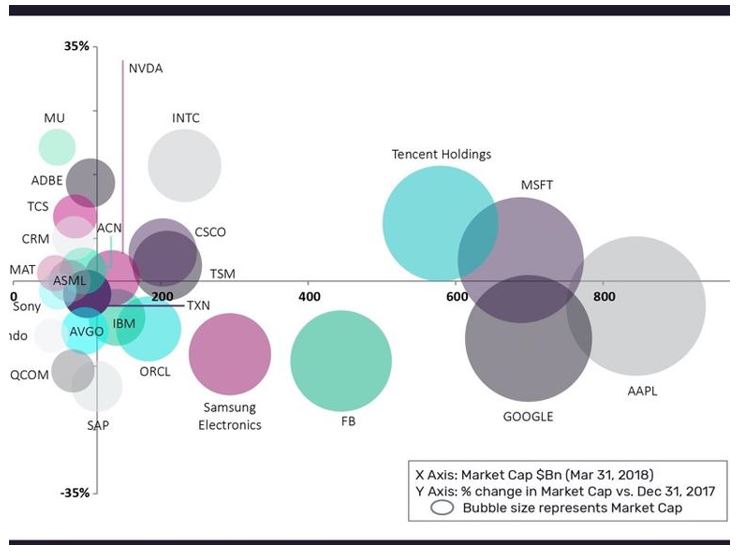

It leads the breakaway group of Microsoft, Tencent and Google…followed by Facebook and the rest of the peloton.

|

Source: GlobalData |

Why is this significant?

Well, it’s not really…$1 trillion is a number just like any other number.

But the runaway growth is evidence of a bigger trend — one that investors like you CANNOT ignore.

Some, like Mad Money’s Jim Cramer, think that you should double down…because AAPL is cheap (according to him). He reckons that sceptics, like me, are talking ‘poppycock’. That the stock should be 50% more expensive than it is today.

Others, like Bloomberg, figure that the numbers aren’t adding up.

Think about what makes a stock price go up or down.

- Fundamentals — the business’ operating results

- Emotions — market sentiment towards that business

- Expectations — what the business could do in the future

- Supply and Demand — the number of shares compared to the demand

Fundamentals and expectations are tied directly to the success of the business.

Run the numbers. Calculate. If it’s undervalued, buy. If overvalued, sell.

Emotion is a bit more abstract, but still affects prices. Fear. Confidence. Trust.

The last factor, particularly supply, is more arbitrary. The business decides how many shares to offer. There’s a bit of strategy behind it, but it doesn’t necessarily correlate with how successful a company is.

Take Berkshire Hathaway [NYSE:BRK-A] for example. Warren Buffett’s enterprise is one of the most valuable companies in the US, but only offers 750,000 shares.

On the other hand, Advanced Micro Devices Inc [NASDAQ:AMD] has a market cap 1/27th the size of Berkshire Hathaway, but offers over 118 million shares.

It doesn’t matter much how many shares there are. The market will figure out a price by balancing supply and demand. That’s why Berkshire Hathaway’s stock costs over $300,000 each and AMD’s costs less than $20.

But there’s a way to game the system… [openx slug=inpost]

A rotten apple

Let’s say you offer 100 shares and the market decides that they’re worth $20 each.

As a company, you grow your business and over time, investors place more and more confidence in your business.

The stock price rises to $25 each.

Other investors see the upward trend and try to buy.

That raises the price to $30 each.

But one day, you decide you want to drive the stock to $50. How would you do it?

You’d cut down supply by buying some of the stocks yourself.

So you buy back 35 stocks and lower supply drives the price up to $55.

What you’ve just done is a tactic called ‘stock buybacks’ and it’s a way for listed companies to boost their stock price. There’s not necessarily a fundamental or emotional reason for the price increase, it’s a reduction in supply.

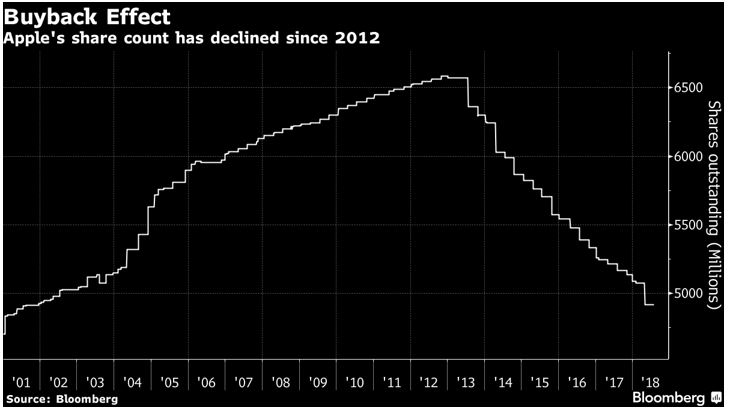

And Apple is a chronic offender.

Since 2012, Apple has been rapidly buying back stocks…and the stock price has skyrocketed.

|

Source: Bloomberg |

Don’t upset the apple cart

It’s made shareholders happy. Their shares claim a greater part of Apple’s future earnings. It bumps up earnings per share. It means Apple’s execs getting a bigger bonus (since bonuses are often tied to shares).

But most importantly, it props up the share price at the opportunity cost of company funds that could have been spent elsewhere.

In other words, every dollar companies spend on reducing their share counts is a dollar not spent on hiring new workers, maintaining factories and machinery, and researching and developing new products.

It’s a short-term boom…

That’s the problem with regular buybacks — they become increasingly harder to pull off.

When there are more shares, it costs less to buy a million of them. As the total shares outstanding drops, each one costs more and more…making each million-share buyback more expensive.

And at some point, it becomes too expensive. Buybacks plateau or reverse. That upward price trend that shareholders have been enjoying starts to top off…or fall.

Bill Bonner had it figured out four years ago when he said:

‘It’s no coincidence that the last time there was a buyback boom, buybacks peaked at almost the top for the stock market — in Q3 2007.

This time, too, fantasy will eventually give way to reality…’

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.