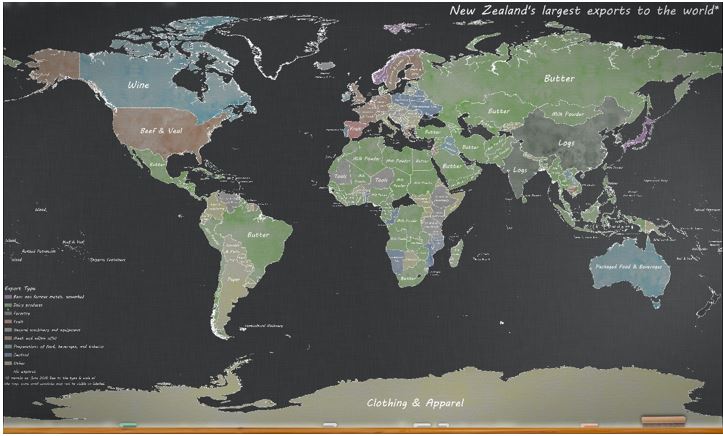

Today, I’d like to share a fascinating map produced by Stats NZ — New Zealand’s largest exports to the world.

|

Source: Stats NZ |

Feel free to click on the image to see the full resolution if you find it hard to read.

Personally, I found it riveting…and I was surprised by many of the exports listed.

Cars to Norfolk Island?

Aircraft and parts to Bolivia?

Bovine hides to Romania?

Who knew?

And as one Reddit user, u/chajman put it, ‘Nice to see that at least one market values NZ-made clothing and apparel!’

What can we learn?

Unsurprisingly, you’ll find the map dominated by dairy products, meat and timber.

You’ll also find that we often sell products to countries where they produce more of that product than we do, but they import it from us nonetheless.

Like the United States with beef. Or Norway with aluminium. Or Portugal with fruit.

Why is that?

It’s because of something called ‘comparative advantage’.

That’s when an economy is able to produce goods at a lower opportunity cost than its trade partner.

Not necessarily at lower costs…just lower opportunity costs. What’s the difference?

Well, opportunity cost is the cost of choosing one activity over any other.

For example, my first job was in a print shop. It was a small operation, and I primarily spent my time doing menial tasks like trimming prints or operating the die cutter.

I quickly realised that my boss, Andy, could do anyone’s job in the shop better than they could. He was an industry veteran and — believe it or not — had a degree in print-shop management.

Talk about knowing what you want to do in life.

Anyways, Andy was better at running the printers than the operators were. He was better at cutting down reams of paper than I was. He could set up mailers faster than anyone else. He was the best at everything.

But at some point, he had to choose what he’d spend his time on because there are only so many hours in the day. He chose sales, because that’s where he could make the biggest difference to the business’ bottom line.

So even though he was better at trimming than I was, he wanted me to do it so that he could allocate his resources on something more productive.

That’s what a lot of these trade partners do as well. They may be better at producing something that New Zealand, but they’d be much better off if they specialised in something else. So that’s why they import from us.

Other times, we have what’s called an ‘absolute advantage’. If we can produce something much faster and more cheaply and at a higher quality than a partner, then we have an ‘absolute advantage’ over them, so there’s no reason for them not to import it.

With the example of my print-shop experience, if I had been better than Andy at trimming paper…and was faster…and was cheaper in terms of pay, there would be no reason for Andy to ever trim paper instead of me.

It’s an idea that Adam Smith first systematically introduced in his economic primer, An Inquiry into the Nature and Causes of the Wealth of Nations. The book, which is about as pithy as its title, helped break down how European countries could best use trade to their advantage.

It was later supplemented by another economist named David Ricardo. He really dove into the idea of opportunity cost and how you should allocate your time based on what you’re not doing instead of what you’re doing.

A real-life example is if your wife is gabbing your ear off about her day, you’re probably sitting there thinking about all the other things you could be doing — analysing your opportunity cost.

In the end, you probably choose to stay and listen because the cost of NOT listening to her would be far greater than the cost of NOT doing anything else.

That’s opportunity cost.

Back to the map, I’d like to zoom in on Europe.

|

Source: Stats NZ |

Notice something fishy?

I’m not talking about the exceptional amount of unprocessed fish going to Eastern Europe.

I’m talking about New Zealand’s bread and butter — butter.

With the exception of the Danes, Europe doesn’t seem to be importing much dairy. You can thank the EU for that…

It currently provides significant subsidies to European dairy farmers and charges steep tariffs to exporters like Fonterra. It’s very much a protected industry.

But those walls could come tumbling down soon.

Turning the map green…

As we hinted a week ago, Brexit could have some game-changing implications for New Zealand’s dairy export industry.

The first cracks in the wall are starting to appear. Milk Magazine says:

‘The European Union could soon cut subsidies to dairy farmers, and the blame is being put squarely on the back of the United Kingdom and its pending exit from the trading bloc. Due to higher labour costs and stricter environmental regulations in Europe compared to those in the United States, EU dairy producers have a higher cost of production, and without subsidies, EU producers would find it harder to compete with the United States and New Zealand in world dairy markets.’

They chose the word ‘blame’ to describe the UK’s role in the issue. Here in New Zealand, we might prefer to say ‘credit’ instead because this is nothing but good news for us.

It’s more or less an untapped market…and we’re about to get the green light.

From an economic perspective, this means that Kiwi producers are about to access a whole new level of demand. If supply remains roughly the same, then that means prices will rise. As prices rise, New Zealand producers will make a greater profit margin, allowing them to reinvest more profits into their businesses. Business expansions will lead to greater supply, increased exports, and so on…

Europe’s piece of the map could get a whole lot greener…

And Kiwi dairy investors could get a whole lot richer…

Until next time,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.