Yesterday, I met a nice gentleman named Paul.

He lives in St Mary’s Bay in Auckland. If you’re not familiar, it’s an old neighbourhood up on one of the tallest hills in the city. It’s also one of the most expensive places to live in New Zealand.

Paul has lived in Auckland his whole life and remembers how different the city was in the 50s and 60s.

He remembered how Ponsonby and Grey Lynn transformed from poorer, working-class suburbs to affluent, even ‘yuppie’ neighbourhoods.

He noted the stark contrast between the bicultural demographics of his childhood and the wide ethnic spectrum you’ll find in the streets of Auckland today.

He remembers when people could afford to buy houses without having to sell their firstborn.

Paul himself purchased the home he now lives in over 30 years ago.

He paid $164,000 (And still has all of his arms, legs, and children).

It’s a cosy little place. A small front yard and a tiny back garden. Three bedrooms and a small deck attached to the attic.

It’s even got a working fireplace, which Paul informed me is a rarity these days.

He and I sat in two comfy Eames chairs in front of the crackling fire and talked about today’s property market.

I told him that I was on the hunt for a new place…and that I was considering living in his area. I was looking for a couple bedrooms for $400/week or less.

To me, that seemed generous.

My parents rent a place in the States with 4 bedrooms on a lot about the size of a rugby pitch. It costs them $900 per month.

I knew that Auckland’s pricy, so I figured I’d roughly double the budget and halve the number of rooms, and I should be in the right ballpark.

Paul scoffed.

He said, ‘I’ve got a friend who has a place for rent. It’s not in a great location… and it’s small — a studio…and in an older apartment building. She’d be willing to rent it to you for the small sum of $500 per week. And between you and me, that’s a steal.’

A steal indeed. But I’m not sure I’d be the one stealing…

A little back-of-napkin math and you’ll realise that $500/week is $71/night.

For that amount, I can get a hotel or AirBnB that comes with electricity, water, utilities, repairs, and a cleaner! Maybe even breakfast!

It’s more cost-effective to live in a hotel than to rent an apartment.

But that’s the reality of today’s puffed up property market.

I asked Paul if he’d had his house appraised recently…remember, he paid $164,000 thirty years ago.

He leaned in and whispered, ‘This puppy’s valued north of $2 million. And in today’s market, you could bank on buyers paying a 10-20% premium on top.’

$2 million.

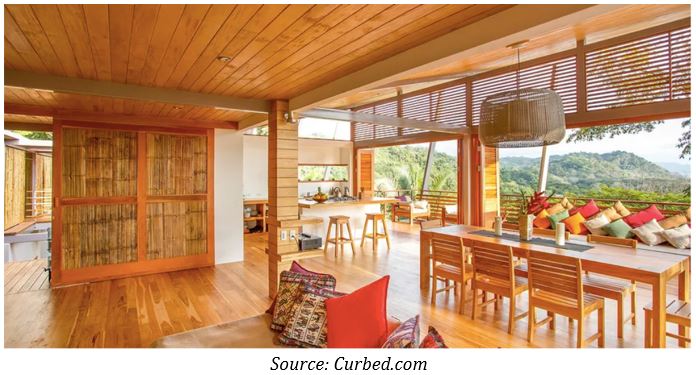

You could buy this dreamy sky mansion in Costa Rica for the same price.

Or in Auckland, New Zealand, you could get a 50-year-old house just big enough for a small family.

I recognise that you probably identify more with Paul than you do with me.

Maybe you bought a home in the last few decades and you’ve watched it appreciate.

And you’re thinking about retirement or your children…and you want to make the most of your now sizeable equity.

You might not think that today’s bloated prices, like my example of a $500/week rental, make a difference. You already bit the bullet. And now you’re on the right side of a seller’s market.

Frankly, that would be a dangerous assumption.

You see, markets work in cycles. Property investor and market guru Michael Yardney describes the property cycle in four steps:

- Boom

- Downturn

- Stabilisation

- Upturn

My educated guess is that we’re at the end of the boom period — 11:55 on Yardney’s cycle.

Prices have skyrocketed over several decades…and now it’s time to pay the piper.

The next stage could be the downturn where prices fall and homeowners like you watch as their equity disappears into thin air.

The question is — how far will it fall?

If the market corrects by 20%, Paul will be out at least $400,000. And 20% would be a soft blow.

We’re already observing the start of corrections in places like Central Otago, where the average price dropped by $67,000 in the last quarter.

How much longer until the contagion effect reaches you?

The two options…

I suppose you’ve got two options available: gamble that the market keeps exploding…or…cash out.

If you decide to stay in and gamble that the bull market continues, good luck. You’ve got a stronger stomach than I. That sort of vulnerable illiquid asset gives me the jitters.

If you decide to cash out, you can always get into stocks or cryptos, or you could buy that house in Costa Rica.

$2 million buys a lot of piña coladas.

Best,

Taylor

PS: Let me know what you think! And if you disagree with me, prove me wrong! You can reach me at [email protected]

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.